免费 Atria Oyj Series A (ATRAV) 技术分析信号

整体信号

中性

最后更新 / 周期

04 Dec / 每日

类别/货币

股票/USD

交易所/国家

XHEL/芬兰

Atria Oyj Series A (ATRAV) 在 04 Dec 的技术分析信号

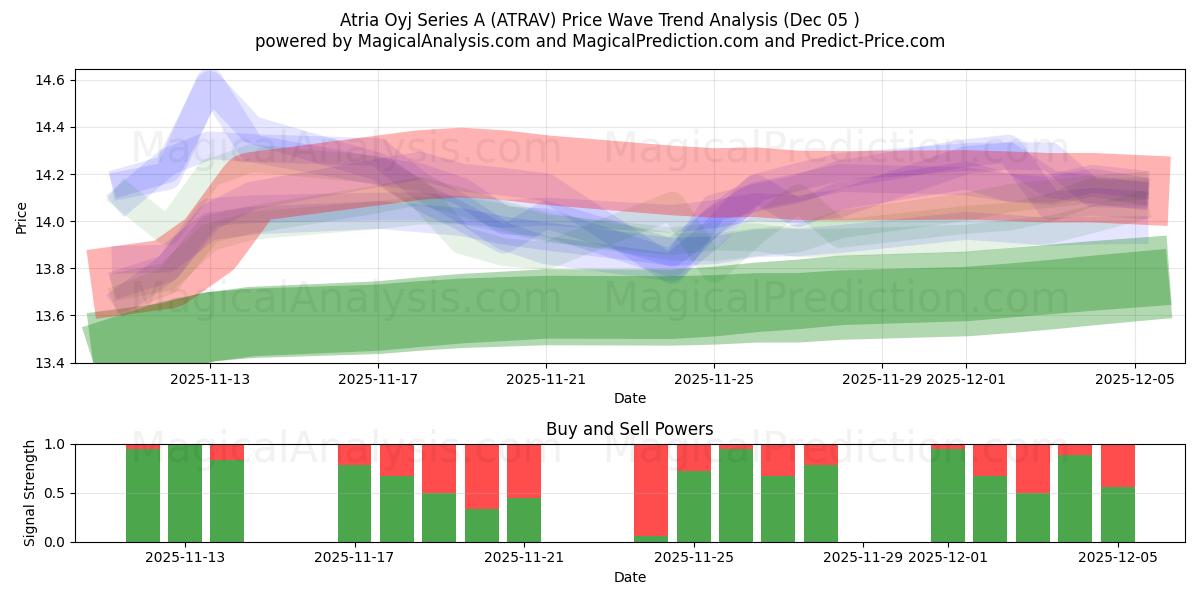

在04 Dec,我们对Atria Oyj Series A (ATRAV)进行了全面的技术分析,考虑了256个信号及其复杂细节。以下是主要发现:7个买入信号建议买入策略,而5个卖出信号则指示卖出策略。其余的87个信号保持中立,没有提供特定方向。

这256个信号被分为四种不同的策略,每种策略包含64个信号。让我们深入每种策略的细节:

策略1:

买入信号:

卖出信号:

中立信号:

结果:该策略导致头寸。

策略2:

买入信号:

卖出信号:

中立信号:

结果:该策略导致头寸。

策略3:

买入信号:

卖出信号:

中立信号:

结果:该策略导致头寸。

策略4:

买入信号:

卖出信号:

中立信号:

结果:该策略导致头寸。

总体策略:

买入信号:7

卖出信号:5

中立信号:87

结果:该策略导致中性头寸。

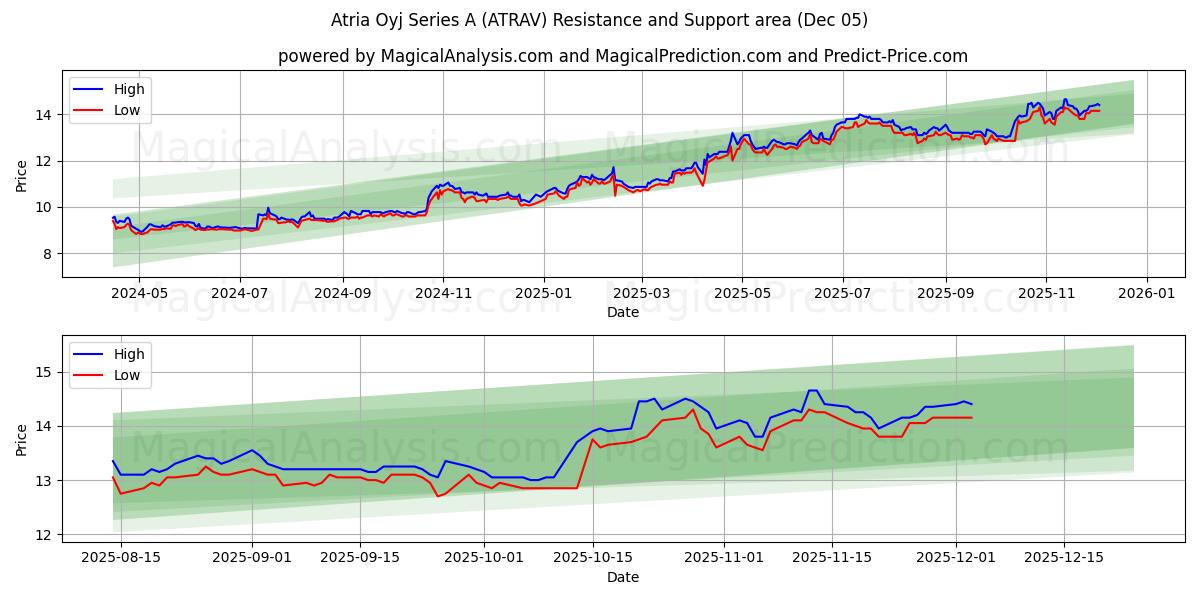

第二支撑位:11.714

如果第一个支撑位被突破,第二个支撑位在11.714将成为一个关键点。突破此水平将表明更强的下行势头,可能受到市场情绪或外部因素的驱动。

第三支撑位:10.054

如果第二个支撑位被突破,价格继续下跌,这表明市场出现重大转变。若价格持续低于10.054,将确认持续的下行趋势,交易者可能会将此第三支撑位作为下一个关键支撑点。

这些支撑位应在更广泛的市场趋势和指标背景下仔细考虑。保持警惕并持续分析市场将使您在交易Atria Oyj Series A (ATRAV)时做出明智的决策。关注这些支撑位将帮助您适应市场的动态变化并做出更明智的交易选择。 密切关注这些阻力位并将其考虑在更广泛的市场趋势和指标背景下是至关重要的。在交易Atria Oyj Series A (ATRAV)时,保持警觉并持续分析市场。关注这些阻力位以及更广泛的市场动态将帮助您做出更明智的交易决策并适应不断变化的市场条件。

这256个信号被分为四种不同的策略,每种策略包含64个信号。让我们深入每种策略的细节:

策略1:

买入信号:

卖出信号:

中立信号:

结果:该策略导致头寸。

策略2:

买入信号:

卖出信号:

中立信号:

结果:该策略导致头寸。

策略3:

买入信号:

卖出信号:

中立信号:

结果:该策略导致头寸。

策略4:

买入信号:

卖出信号:

中立信号:

结果:该策略导致头寸。

总体策略:

买入信号:7

卖出信号:5

中立信号:87

结果:该策略导致中性头寸。

免责声明! 请在做出任何财务决策之前谨慎考虑。请注意,我们的信号仅基于每日价格变动,未考虑新闻、市场情绪或公司动态等外部因素。我们强烈建议考虑所有相关因素并进行自己的研究。

有用的提示: 为了对您的Atria Oyj Series A (ATRAV)投资做出最明智的决策,我们强烈建议访问“magicalprediction”人工智能模型信号网站。它们提供免费信号,如果其中一个与我们的信号一致,那可能是一个可靠的指标,正如我们观察到的那样。

第二支撑位:11.714

如果第一个支撑位被突破,第二个支撑位在11.714将成为一个关键点。突破此水平将表明更强的下行势头,可能受到市场情绪或外部因素的驱动。

第三支撑位:10.054

如果第二个支撑位被突破,价格继续下跌,这表明市场出现重大转变。若价格持续低于10.054,将确认持续的下行趋势,交易者可能会将此第三支撑位作为下一个关键支撑点。

这些支撑位应在更广泛的市场趋势和指标背景下仔细考虑。保持警惕并持续分析市场将使您在交易Atria Oyj Series A (ATRAV)时做出明智的决策。关注这些支撑位将帮助您适应市场的动态变化并做出更明智的交易选择。 密切关注这些阻力位并将其考虑在更广泛的市场趋势和指标背景下是至关重要的。在交易Atria Oyj Series A (ATRAV)时,保持警觉并持续分析市场。关注这些阻力位以及更广泛的市场动态将帮助您做出更明智的交易决策并适应不断变化的市场条件。

Atria Oyj Series A (ATRAV) 技术分析图

Atria Oyj Series A (ATRAV) 支撑和阻力位

| 名称 | Level1 | Level2 | Level3 | Level4 | Level5 |

|---|---|---|---|---|---|

| 阻力位 | -- | -- | -- | -- | -- |

| 支撑位 | 12.7 | 11.714 | 10.054 | -- | -- |

Atria Oyj Series A (ATRAV) 信号列表 04 Dec

| Overall Signals |

|---|

Atria Oyj Series A (ATRAV) 04 Dec 的蜡烛图形态

Today's Atria Oyj Series A (ATRAV) Candle Patterns List:

Doji Gravestone Doji Long Legged Doji

过去几天的 Atria Oyj Series A (ATRAV) 技术分析

| # | Date | Overal Signals | ALL Signals |

|---|---|---|---|

| 1 | 04 Dec | N | KAMA 1KAMA 2KAMA 3KAMA 4WMA Crossover 3MIDPOINT Slope 2MIDPOINT Slope 4TEMA Price 3TRIMA Slope 2ROCR Threshold 1ROCR Threshold 2BOP Smoothed ThresholdADXR with DI+/DI-Elder's Force IndexCMO Divergence 1 |

| 2 | 03 Dec | B | KAMA 1KAMA 2KAMA 3KAMA 4TRIMA Slope 2MOM Crossover 1ROC Threshold 2ROCR Threshold 3BOP Smoothed ThresholdSTOCH Normal Zone CrossADXR with DI+/DI-Ichimoku 1Coppock Curve |

| 3 | 02 Dec | N | KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 1TRIMA Slope 1MOM Crossover 2Stochastic RSI SignalOBV CrossoverElder's Force Index |

| 4 | 01 Dec | N | KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 2MIDPOINT Slope 4TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 3AROONOSC 3BOP Smoothed ThresholdOBV CrossoverElder's Force IndexCMO Divergence 1 |

| 5 | 28 Nov | B | EMA Price Cross 1EMA Price Cross 2EMA Price Cross 4KAMA 1KAMA 2KAMA 3KAMA 4EMA Crossover 2WMA Crossover 2TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 3AROONOSC 1AROONOSC 2ROCR Threshold 1ROCR Threshold 4BOP Smoothed ThresholdMACD Crossover 1Ichimoku 1Ichimoku 2Ichimoku 3CMO Divergence 1CMO Divergence 2 |

| 6 | 27 Nov | B | EMA Price Cross 1EMA Price Cross 2EMA Price Cross 4KAMA 3KAMA 4MIDPOINT Slope 1MIDPOINT Slope 3TRIMA Slope 1TRIMA Slope 2ROC Threshold 1ROCR Threshold 2BOP Smoothed ThresholdStochastic RSI SignalIchimoku 2Daily Pivot Point 1 |

| 7 | 26 Nov | S | KAMA 1KAMA 3KAMA 4EMA Crossover 1WMA Crossover 1TEMA Price 1TEMA Price 2TRIMA Slope 2BOP Smoothed ThresholdSTOCH Normal Zone CrossIchimoku 2CMO Divergence 1 |

| 8 | 25 Nov | B | EMA Price Cross 1EMA Price Cross 2EMA Price Cross 3EMA Price Cross 4KAMA 3KAMA 4WMA Crossover 3T3 Slope 1TEMA Price 1TEMA Price 2TRIMA Slope 2MOM Crossover 2ROC Threshold 2ROCR Threshold 3BBANDS Breakout 1Stochastic RSI SignalUltimate OscillatorMoney Flow IndexDaily Pivot Point 1Rolling VWAPCMO Divergence 2 |

| 9 | 24 Nov | B | DEMA 2DEMA 3KAMA 1MIDPOINT Slope 1MIDPOINT Slope 2MIDPOINT Slope 3T3 Slope 1TEMA Price 2TEMA Price 3TRIMA Slope 1SAR CrossoverMOM Crossover 1MOM Crossover 2PLUS_DI Threshold 1ROCR Threshold 2ROCR Threshold 4BOP Smoothed ThresholdDaily Pivot Point 1CMO Divergence 1 |

| 10 | 21 Nov | S | DEMA 3KAMA 3KAMA 4EMA Crossover 2MIDPOINT Slope 3TEMA Price 3TRIMA Slope 1TRIMA Slope 3ROC Threshold 2ROCR Threshold 3WILLR Exit OversoldBOP Smoothed ThresholdCMO Divergence 1 |

| 11 | 20 Nov | N | DEMA 2DEMA 3EMA Price Cross 3KAMA 3KAMA 4MIDPOINT Slope 2TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 3AROONOSC 1AROONOSC 3ROCR Threshold 1ROCR Threshold 4BOP Smoothed ThresholdBBANDS Breakout 1Ichimoku 2Rolling VWAPCMO Divergence 1 |

| 12 | 19 Nov | S | EMA Price Cross 2KAMA 3KAMA 4WMA Crossover 2T3 Slope 2TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3MOM Crossover 2ROC Threshold 1ROCR Threshold 4BOP Smoothed ThresholdCMO Divergence 1 |

| 13 | 18 Nov | N | EMA Price Cross 1KAMA 3KAMA 4EMA Crossover 1WMA Crossover 1MIDPOINT Slope 1T3 Slope 2TEMA Price 2TEMA Price 3TRIMA Slope 2BOP Smoothed ThresholdMACD Crossover 1MACD Crossover 2Daily Pivot Point 1CMO Divergence 1 |

| 14 | 17 Nov | S | KAMA 2KAMA 3KAMA 4T3 Slope 1T3 Slope 2TRIMA Slope 1TRIMA Slope 2CCI Crossover 2MOM Crossover 2PLUS_DI Threshold 1ROCR Threshold 3BOP Smoothed ThresholdSTOCH Normal Zone CrossChaikin AD CrossoverADXR with DI+/DI-CMO Divergence 1 |

| 15 | 14 Nov | N | DEMA 1EMA Price Cross 4KAMA 2KAMA 3KAMA 4MIDPOINT Slope 2T3 Slope 1T3 Slope 2TEMA Price 1TRIMA Slope 1TRIMA Slope 2AROONOSC 2CCI Crossover 1CCI Crossover 3PLUS_DI Threshold 1PLUS_DI Threshold 2RSI Exit OversoldBOP Smoothed ThresholdBBANDS Breakout 2Stochastic RSI SignalOBV CrossoverChaikin ADOSC Zero CrossADXR with DI+/DI-Daily Pivot Point 1Elder's Force Index |

| 16 | 13 Nov | N | DEMA 1DEMA 2DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4WMA Crossover 3MIDPOINT Slope 1MIDPOINT Slope 2MIDPOINT Slope 3T3 Slope 1TEMA Price 1TEMA Price 2TEMA Price 3TRIMA Slope 1AROONOSC 1AROONOSC 3MOM Crossover 1PLUS_DI Threshold 1PLUS_DI Threshold 2ROC Threshold 1ROCR Threshold 2WILLR Exit OverboughtBOP Smoothed ThresholdMACD Crossover 2Chaikin ADOSC Zero CrossADXR with DI+/DI-Keltner Channel 1Donchian ChannelCMO Divergence 1 |

| 17 | 12 Nov | B | KAMA 2KAMA 3KAMA 4MIDPOINT Slope 1MIDPOINT Slope 3TEMA Price 2TEMA Price 3TRIMA Slope 1MOM Crossover 2ROC Threshold 2ROCR Threshold 3WILLR Exit OversoldBOP Smoothed ThresholdOBV CrossoverChaikin AD CrossoverADXR with DI+/DI-Elder's Force IndexCMO Divergence 1 |

| 18 | 11 Nov | B | KAMA 2KAMA 3KAMA 4WMA Crossover 2MIDPOINT Slope 3MIDPOINT Slope 4TEMA Price 2TEMA Price 3TRIMA Slope 1SAR CrossoverMOM Crossover 2ROC Threshold 1ROC Threshold 2ROCR Threshold 2ROCR Threshold 3BOP Smoothed ThresholdMACD Crossover 1ADXR with DI+/DI-CMO Divergence 1 |

| 19 | 10 Nov | B | DEMA 1EMA Price Cross 1EMA Price Cross 2EMA Price Cross 4KAMA 3KAMA 4EMA Crossover 1EMA Crossover 2WMA Crossover 1MIDPOINT Slope 1MIDPOINT Slope 2MIDPOINT Slope 4TEMA Price 1TEMA Price 2TRIMA Slope 2CCI Crossover 1ROCR Threshold 1BOP Smoothed ThresholdSTOCH Normal Zone CrossBBANDS Breakout 1ADXR with DI+/DI-Ichimoku 3Vortex IndicatorCMO Divergence 1 |

| 20 | 07 Nov | B | EMA Price Cross 3MIDPOINT Slope 4TEMA Price 3TRIMA Slope 2AROONOSC 4MOM Crossover 2PLUS_DI Threshold 1PLUS_DI Threshold 2ROCR Threshold 2ROCR Threshold 3Stochastic RSI SignalHammer / Hanging ManRolling VWAP |

| 21 | 06 Nov | N | WMA Crossover 3T3 Slope 1TEMA Price 3TRIMA Slope 2AROONOSC 2PLUS_DI Threshold 1PLUS_DI Threshold 2TRIX Crossover 2BOP Smoothed ThresholdPercentage Price Oscillator |

| 22 | 05 Nov | S | DEMA 2DEMA 3EMA Price Cross 3MIDPOINT Slope 2T3 Slope 1TEMA Price 2TEMA Price 3TRIMA Slope 1MOM Crossover 1MOM Crossover 2ADX +DI/-DI CrossoverPLUS_DI Threshold 1PLUS_DI Threshold 2ROC Threshold 1ROCR Threshold 2ROCR Threshold 3WILLR Exit OversoldWILLR Exit OverboughtBOP Smoothed ThresholdBBANDS Breakout 1Daily Pivot Point 1Rolling VWAPVortex IndicatorCMO Divergence 2 |

| 23 | 04 Nov | S | EMA Price Cross 3KAMA 4EMA Crossover 2MIDPOINT Slope 2T3 Slope 1TEMA Price 1TEMA Price 3TRIMA Slope 1PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdStochastic RSI SignalIchimoku 3Rolling VWAP |

| 24 | 03 Nov | N | DEMA 1DEMA 2DEMA 3EMA Price Cross 3WMA Crossover 2MIDPOINT Slope 1MIDPOINT Slope 2TEMA Price 2TEMA Price 3TRIMA Slope 1AROONOSC 1AROONOSC 3PLUS_DI Threshold 1PLUS_DI Threshold 2ROCR Threshold 1TRIX Crossover 1WILLR Exit OversoldBOP Smoothed ThresholdMACD Crossover 2OBV CrossoverVolume SpikeDaily Pivot Point 1Rolling VWAPElder's Force IndexCMO Divergence 1 |

| 25 | 31 Oct | S | DEMA 2EMA Price Cross 2KAMA 3KAMA 4EMA Crossover 1MIDPOINT Slope 1TEMA Price 2TEMA Price 3SAR CrossoverPLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdCMO Divergence 1 |

| 26 | 30 Oct | S | DEMA 1DEMA 2EMA Price Cross 1EMA Price Cross 4KAMA 3KAMA 4WMA Crossover 1TEMA Price 1TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 3CCI Crossover 1CCI Crossover 2ROCR Threshold 1BOP Smoothed ThresholdMACD Crossover 1STOCH Normal Zone CrossMoney Flow IndexChaikin ADOSC Zero CrossVolume SpikeDaily Pivot Point 1CMO Divergence 1 |

| 27 | 29 Oct | S | DEMA 3KAMA 2KAMA 3KAMA 4TRIMA Slope 1TRIMA Slope 3RSI Exit OversoldBOP Smoothed ThresholdADXR with DI+/DI- |

| 28 | 28 Oct | B | DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4WMA Crossover 1MIDPOINT Slope 1TEMA Price 1TEMA Price 2TEMA Price 3TRIMA Slope 2TRIMA Slope 3WILLR Exit OversoldWILLR Exit OverboughtBOP Smoothed ThresholdMACD Crossover 1STOCH Normal Zone CrossChaikin ADOSC Zero CrossDEMA with ATR 3ADXR with DI+/DI-Keltner Channel 1Daily Pivot Point 1CMO Divergence 1 |

| 29 | 27 Oct | B | KAMA 1KAMA 2KAMA 3KAMA 4WMA Crossover 1MIDPOINT Slope 1MIDPOINT Slope 3TRIMA Slope 2TRIMA Slope 3ROCR Threshold 1BOP Smoothed ThresholdStochastic RSI SignalChaikin ADOSC Zero CrossADXR with DI+/DI- |

| 30 | 24 Oct | B | EMA Price Cross 4KAMA 3KAMA 4TEMA Price 2TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3AROONOSC 4BOP Smoothed ThresholdMACD Crossover 1Chaikin AD CrossoverADXR with DI+/DI- |

Atria Oyj Series A (ATRAV) 用户预测

你的预测是什么?

In this section, you can easily predict without user registration. See also other users predictions.

你的预测是什么?

Atria Oyj Series A (ATRAV) predictions by visitors

请填写您的电子邮件

请填写文本

请填写验证码