免费 美元/人民币 (CNY) 技术分析信号

整体信号

卖出

最后更新 / 周期

19 Feb / 每日

类别/货币

货币/CNY

交易所/国家

CCY/--

美元/人民币 (CNY) 在 19 Feb 的技术分析信号

在19 Feb,我们对美元/人民币 (CNY)进行了全面的技术分析,考虑了256个信号及其复杂细节。以下是关键发现:4个信号建议买入策略,而8个信号则指向卖出策略。其余的87个信号保持中立,没有提供特定方向。

这256个信号被分为四种不同的策略,每种策略包含64个信号。让我们深入了解每种策略的细节:

策略1:

买入信号:

卖出信号:

中立信号:

结果:该策略导致的头寸。

策略2:

买入信号:

卖出信号:

中立信号:

结果:该策略导致的头寸。

策略3:

买入信号:

卖出信号:

中立信号:

结果:该策略导致的头寸。

策略4:

买入信号:

卖出信号:

中立信号:

结果:该策略导致的头寸。

总体策略:

买入信号:4

卖出信号:8

中立信号:87

结果:该策略导致卖出的头寸。

结果:查看对美元/人民币 (CNY)的技术分析,基于历史数据和分析,存在向卖出信号的倾向。然而,重要的是要记住,这些信号并不是保证。请确保仔细考虑整体市场状况,并将您的决策与具体的投资目标相一致。

根据以上信号和预测,我们推荐以下策略:

美元/人民币 (CNY) 对于那些处于买入头寸(长头寸)的人: 如果您目前处于买入(长)头寸,建议根据技术信号的组合识别最佳出场时机。风险承受能力较高的投资者可以选择等待并观察未来几天的市场动向。

美元/人民币 (CNY) 对于那些处于卖出头寸(短头寸)的人: 如果您处于卖出(短)头寸,持有您的头寸可能是正确的策略,因为我们的技术分析一致显示如此。然而,请小心并密切关注市场动态。

对于新头寸: 如果您目前没有投资或考虑转为卖出(短)头寸,建议根据最低预期价格范围评估潜在下行风险INF%。在进入短头寸之前,请确保这符合您的风险承受能力和目标,并进行充分的研究。

在所有交易场景中,明确的止损策略对于有效管理潜在的下行风险至关重要。

第一个支撑水平:0

我们密切关注价格在0的表现,这是第一个支撑水平。如果下行趋势持续,突破该水平将表明强烈的卖出压力,暗示进一步价格贬值的可能性。

这些支撑水平应在更广泛的市场趋势和指标的背景下仔细考虑。通过保持警惕并持续分析市场,您可以在交易美元/人民币 (CNY)时做出明智的决策。记住这些支撑水平将帮助您适应市场的动态性质,做出更聪明的交易选择。

这256个信号被分为四种不同的策略,每种策略包含64个信号。让我们深入了解每种策略的细节:

策略1:

买入信号:

卖出信号:

中立信号:

结果:该策略导致的头寸。

策略2:

买入信号:

卖出信号:

中立信号:

结果:该策略导致的头寸。

策略3:

买入信号:

卖出信号:

中立信号:

结果:该策略导致的头寸。

策略4:

买入信号:

卖出信号:

中立信号:

结果:该策略导致的头寸。

总体策略:

买入信号:4

卖出信号:8

中立信号:87

结果:该策略导致卖出的头寸。

免责声明! 在做出任何财务决策之前,请谨慎并充分考虑。请注意,我们的信号仅基于每日价格变化,未考虑新闻、市场情绪或公司发展等外部因素。我们强烈建议您考虑所有相关因素并进行自己的研究。

有用提示: 为了更明智地决策关于您的美元/人民币 (CNY)投资,我们强烈推荐访问“magicalprediction”AI模型信号网站。他们提供免费的信号,如果其中一个与我们的信号一致,很可能是一个可靠的指标,因为我们已经观察到这一点。

结果:查看对美元/人民币 (CNY)的技术分析,基于历史数据和分析,存在向卖出信号的倾向。然而,重要的是要记住,这些信号并不是保证。请确保仔细考虑整体市场状况,并将您的决策与具体的投资目标相一致。

根据以上信号和预测,我们推荐以下策略:

美元/人民币 (CNY) 对于那些处于买入头寸(长头寸)的人: 如果您目前处于买入(长)头寸,建议根据技术信号的组合识别最佳出场时机。风险承受能力较高的投资者可以选择等待并观察未来几天的市场动向。

美元/人民币 (CNY) 对于那些处于卖出头寸(短头寸)的人: 如果您处于卖出(短)头寸,持有您的头寸可能是正确的策略,因为我们的技术分析一致显示如此。然而,请小心并密切关注市场动态。

对于新头寸: 如果您目前没有投资或考虑转为卖出(短)头寸,建议根据最低预期价格范围评估潜在下行风险INF%。在进入短头寸之前,请确保这符合您的风险承受能力和目标,并进行充分的研究。

在所有交易场景中,明确的止损策略对于有效管理潜在的下行风险至关重要。

有用提示: 对于长期预测,我们建议使用“Predict-price”网站,该网站免费提供短期和长期预测。这个资源可以支持您对**美元/人民币 (CNY)**投资的明智决策。

美元/人民币 (CNY)价格分析和支撑水平:

在我们当前的美元/人民币 (CNY)头寸中,我们发现自己处于短头寸,预计可能会出现下行趋势。了解关键支撑水平至关重要,因为这些是交易者和投资者做出明智决策的重要参考点。第一个支撑水平:0

我们密切关注价格在0的表现,这是第一个支撑水平。如果下行趋势持续,突破该水平将表明强烈的卖出压力,暗示进一步价格贬值的可能性。

这些支撑水平应在更广泛的市场趋势和指标的背景下仔细考虑。通过保持警惕并持续分析市场,您可以在交易美元/人民币 (CNY)时做出明智的决策。记住这些支撑水平将帮助您适应市场的动态性质,做出更聪明的交易选择。

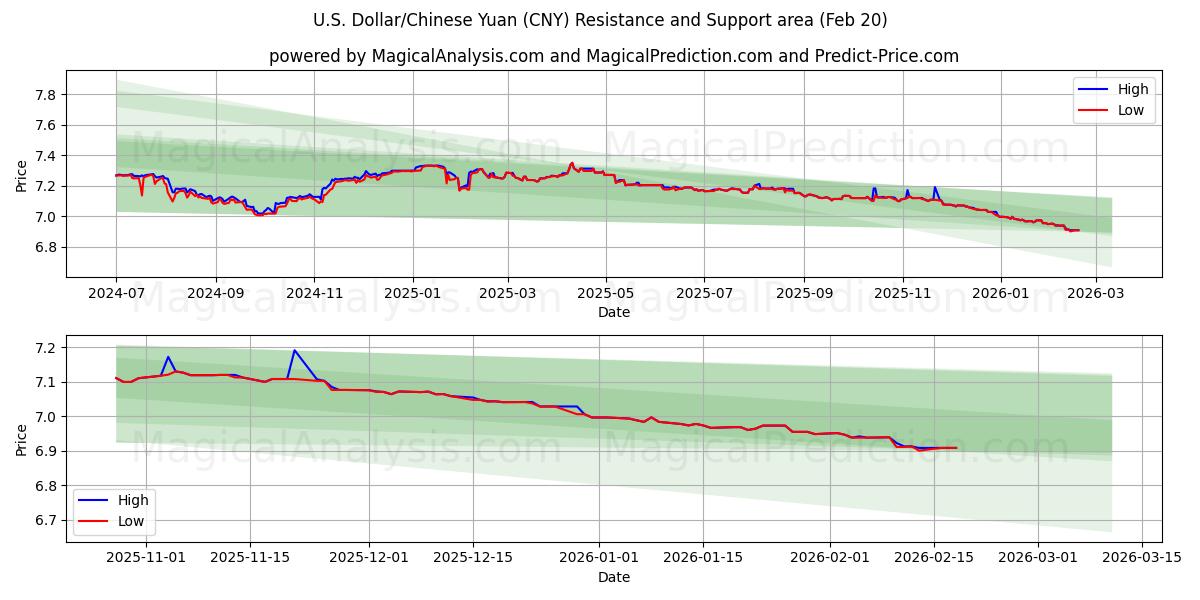

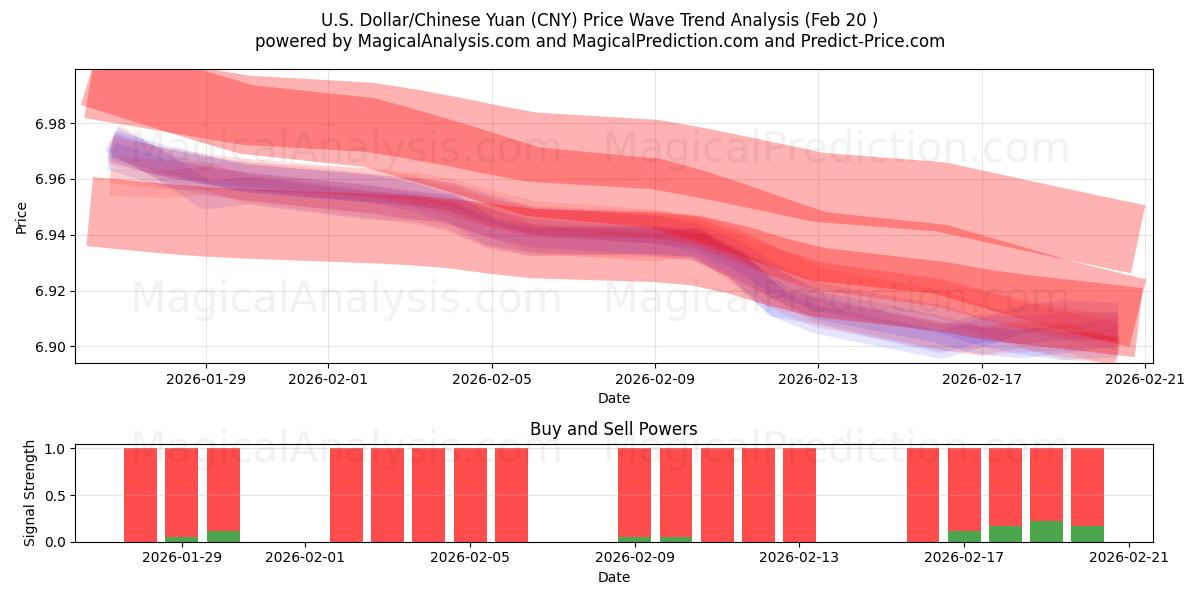

美元/人民币 (CNY) 技术分析图

美元/人民币 (CNY) 支撑和阻力位

| 名称 | Level1 | Level2 | Level3 | Level4 | Level5 |

|---|---|---|---|---|---|

| 阻力位 | -- | -- | -- | -- | -- |

| 支撑位 | -- | -- | -- | -- | -- |

美元/人民币 (CNY) 信号列表 19 Feb

| Overall Signals |

|---|

美元/人民币 (CNY) 19 Feb 的蜡烛图形态

Today's 美元/人民币 (CNY) Candle Patterns List:

Doji Short Line Candle

过去几天的 美元/人民币 (CNY) 技术分析

| # | Date | Overal Signals | ALL Signals |

|---|---|---|---|

| 1 | 19 Feb | S | KAMA 3KAMA 4WMA Crossover 1TEMA Price 2TEMA Price 3TRIMA Slope 2TRIMA Slope 3PLUS_DI Threshold 1PLUS_DI Threshold 2ADXR with DI+/DI- |

| 2 | 18 Feb | S | DEMA 1KAMA 1KAMA 2KAMA 3KAMA 4TEMA Price 2TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3CCI Crossover 1PLUS_DI Threshold 1PLUS_DI Threshold 2MACD Crossover 1ADXR with DI+/DI-CMO Divergence 1 |

| 3 | 17 Feb | S | DEMA 1KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 2TEMA Price 2TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3CCI Crossover 3PLUS_DI Threshold 1PLUS_DI Threshold 2BBANDS Breakout 2Stochastic RSI SignalUltimate OscillatorADXR with DI+/DI-CMO Divergence 1 |

| 4 | 16 Feb | S | DEMA 1DEMA 2DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 1T3 Slope 1T3 Slope 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3PLUS_DI Threshold 1PLUS_DI Threshold 2ROCR Threshold 3ADXR with DI+/DI-Donchian ChannelCMO Divergence 1 |

| 5 | 13 Feb | S | DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 1T3 Slope 1T3 Slope 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3PLUS_DI Threshold 1PLUS_DI Threshold 2STOCH Normal Zone CrossStochastic RSI SignalADXR with DI+/DI- |

| 6 | 12 Feb | S | DEMA 1DEMA 2DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 1MIDPOINT Slope 3MIDPOINT Slope 4T3 Slope 1TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3PLUS_DI Threshold 1TRIX Crossover 1WILLR Exit OversoldMACD Crossover 2Percentage Price OscillatorADXR with DI+/DI-CMO Divergence 1 |

| 7 | 11 Feb | S | DEMA 1DEMA 2DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 1MIDPOINT Slope 2MIDPOINT Slope 3MIDPOINT Slope 4TEMA Price 1TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3PLUS_DI Threshold 1BOP Smoothed ThresholdMACD Crossover 1Ultimate OscillatorHammer / Hanging ManADXR with DI+/DI-Donchian ChannelCMO Divergence 1 |

| 8 | 10 Feb | S | DEMA 2DEMA 3KAMA 2KAMA 3KAMA 4MIDPOINT Slope 3TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3CCI Crossover 1PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdMACD Crossover 1Stochastic RSI SignalADXR with DI+/DI- |

| 9 | 09 Feb | N | KAMA 2KAMA 3KAMA 4TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3CCI Crossover 3PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdADXR with DI+/DI- |

| 10 | 06 Feb | S | KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 4TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdADXR with DI+/DI-CMO Divergence 1 |

| 11 | 05 Feb | S | KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 1MIDPOINT Slope 2MIDPOINT Slope 3T3 Slope 1TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2CMO Crossover 1MACD Crossover 1STOCH Normal Zone CrossADXR with DI+/DI-Donchian ChannelCMO Divergence 1 |

| 12 | 04 Feb | S | KAMA 1KAMA 2KAMA 3KAMA 4T3 Slope 1TRIMA Slope 1TRIMA Slope 2CMO Crossover 2PLUS_DI Threshold 2Stochastic RSI SignalADXR with DI+/DI-Donchian ChannelCMO Divergence 1 |

| 13 | 03 Feb | S | KAMA 2KAMA 3KAMA 4MIDPOINT Slope 2T3 Slope 1TEMA Price 3TRIMA Slope 1TRIMA Slope 2CCI Crossover 3PLUS_DI Threshold 1PLUS_DI Threshold 2MACD Crossover 1Stochastic RSI SignalADXR with DI+/DI-CMO Divergence 1 |

| 14 | 02 Feb | N | KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 1MIDPOINT Slope 2T3 Slope 1TEMA Price 2TRIMA Slope 1AROONOSC 1AROONOSC 3CMO Crossover 1CMO Crossover 2PLUS_DI Threshold 2MACD Crossover 1ADXR with DI+/DI-Donchian ChannelCMO Divergence 1 |

| 15 | 30 Jan | S | KAMA 2KAMA 3KAMA 4MIDPOINT Slope 1T3 Slope 1TEMA Price 3TRIMA Slope 1TRIMA Slope 3CCI Crossover 3PLUS_DI Threshold 1PLUS_DI Threshold 2ADXR with DI+/DI- |

| 16 | 29 Jan | S | KAMA 1KAMA 2KAMA 3KAMA 4TEMA Price 2TRIMA Slope 1TRIMA Slope 3PLUS_DI Threshold 1PLUS_DI Threshold 2STOCH Normal Zone CrossADXR with DI+/DI- |

| 17 | 28 Jan | S | DEMA 1DEMA 2EMA Price Cross 4KAMA 1KAMA 2KAMA 3KAMA 4EMA Crossover 1WMA Crossover 1WMA Crossover 2MIDPOINT Slope 1MIDPOINT Slope 4TEMA Price 1TEMA Price 2TRIMA Slope 3SAR CrossoverPLUS_DI Threshold 1PLUS_DI Threshold 2ROCR Threshold 4WILLR Exit OversoldWILLR Exit OverboughtStochastic RSI SignalADXR with DI+/DI-Donchian ChannelCMO Divergence 1 |

| 18 | 27 Jan | S | DEMA 1DEMA 2DEMA 3WMA Crossover 2TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 3PLUS_DI Threshold 1PLUS_DI Threshold 2ADXR with DI+/DI-CMO Divergence 1 |

| 19 | 26 Jan | B | DEMA 1DEMA 2DEMA 3EMA Price Cross 4EMA Crossover 1WMA Crossover 1TEMA Price 1TEMA Price 2TEMA Price 3TRIMA Slope 2TRIMA Slope 3SAR CrossoverPLUS_DI Threshold 1PLUS_DI Threshold 2RSI Exit OversoldRSI Exit OverboughtADXR with DI+/DI-CMO Divergence 1 |

| 20 | 23 Jan | B | DEMA 1DEMA 2DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 3MIDPOINT Slope 4TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3CCI Crossover 1CCI Crossover 2CCI Crossover 3PLUS_DI Threshold 2TRIX Crossover 2Stochastic RSI SignalUltimate OscillatorADXR with DI+/DI-CMO Divergence 1 |

| 21 | 22 Jan | N | KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3ADXR with DI+/DI-Donchian ChannelCMO Divergence 1 |

| 22 | 21 Jan | S | DEMA 2DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3CCI Crossover 1PLUS_DI Threshold 2MACD Crossover 2Percentage Price OscillatorADXR with DI+/DI- |

| 23 | 20 Jan | N | KAMA 1KAMA 2KAMA 3KAMA 4TEMA Price 3TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3CCI Crossover 2CCI Crossover 3PLUS_DI Threshold 2TRIX Crossover 1STOCH Normal Zone CrossADXR with DI+/DI- |

| 24 | 19 Jan | S | KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3ADXR with DI+/DI-Donchian ChannelCMO Divergence 1 |

| 25 | 16 Jan | S | KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3AROONOSC 3PLUS_DI Threshold 2ADXR with DI+/DI-Donchian ChannelCMO Divergence 1 |

| 26 | 15 Jan | S | KAMA 2KAMA 4TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3CCI Crossover 1CCI Crossover 2PLUS_DI Threshold 2Ultimate OscillatorADXR with DI+/DI- |

| 27 | 14 Jan | N | KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 1MIDPOINT Slope 3MIDPOINT Slope 4TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3AROONOSC 1STOCH Normal Zone CrossADXR with DI+/DI-Donchian ChannelCMO Divergence 1 |

| 28 | 13 Jan | S | KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 4TRIMA Slope 2TRIMA Slope 3PLUS_DI Threshold 2ADXR with DI+/DI-Donchian ChannelCMO Divergence 1 |

| 29 | 12 Jan | S | EMA Price Cross 4KAMA 1KAMA 2KAMA 3KAMA 4TRIMA Slope 2TRIMA Slope 3CMO Crossover 1PLUS_DI Threshold 2WILLR Exit OversoldWILLR Exit OverboughtStochastic RSI SignalUltimate OscillatorADXR with DI+/DI- |

| 30 | 09 Jan | S | DEMA 1DEMA 2EMA Price Cross 4KAMA 1TEMA Price 1TEMA Price 2TEMA Price 3TRIMA Slope 2TRIMA Slope 3CCI Crossover 1CCI Crossover 2PLUS_DI Threshold 1PLUS_DI Threshold 2RSI Exit OversoldMACD Crossover 1Stochastic RSI SignalCMO Divergence 1 |

美元/人民币 (CNY) 用户预测

你的预测是什么?

In this section, you can easily predict without user registration. See also other users predictions.

你的预测是什么?

美元/人民币 (CNY) predictions by visitors

请填写您的电子邮件

请填写文本

请填写验证码