Free Arizona Metals Corp. (AZMCF) Technical Analysis Signals

Arizona Metals Corp. (AZMCF) signal with technical analysis on 22 Apr

Matching Low Short Line Candle

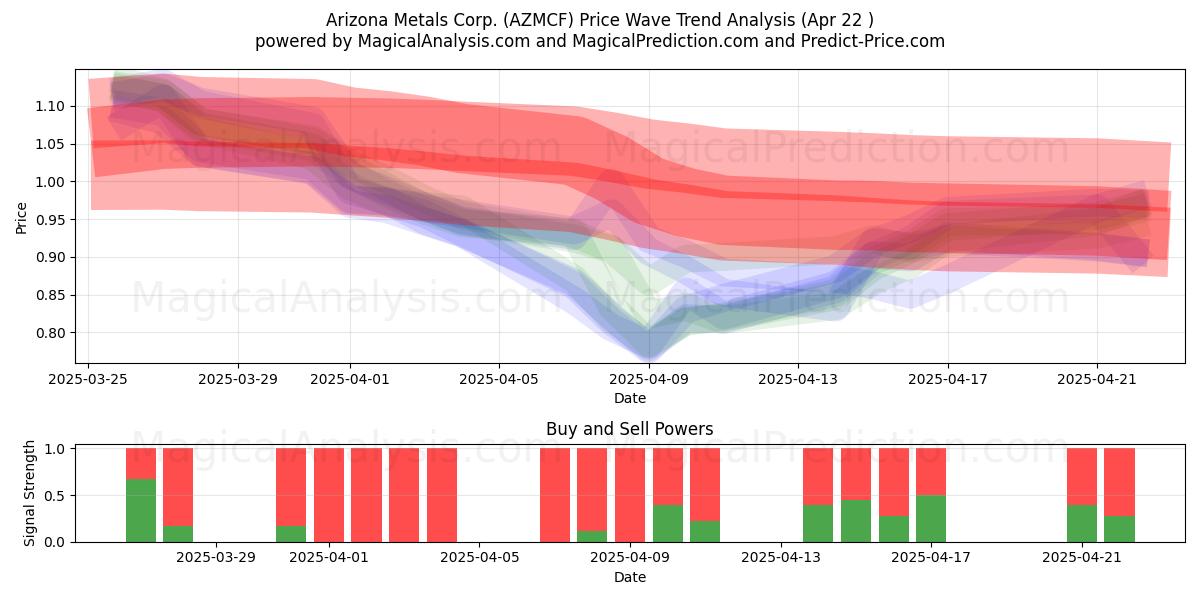

Overall Strategy:

Buy Signals: 62

Sell Signals: 70

Neutral Signals: 124

Result: This strategy leads to a Sell position.

Disclaimer! Please exercise caution and thorough consideration before making any financial decisions. It's important to note that our signals are based solely on daily price changes and do not take into account external factors such as news, market sentiment, or company developments. We strongly recommend considering all relevant factors and conducting your own research.

Useful Tips: To make the most informed decisions about your Arizona Metals Corp. (AZMCF) investments, we highly recommend visiting the "Magic Prediction" AI models signals website. They provide free signals, and if one aligns with ours, it is likely to be a reliable indicator, as we have observed over time.

Result: Looking at the technical analysis for Arizona Metals Corp. (AZMCF) on , there is a tendency towards a sell signal based on historical data and analysis. However, it’s crucial to remember that these signals are not guarantees. Make sure to carefully consider overall market conditions and align your decisions with your specific investment goals.

Based on the above signals and forecasts, we recommend the following strategies:

Arizona Metals Corp. (AZMCF) trading strategy for those in buy positions (long positions): If you are currently in a buy (long) position, it is advisable to identify the optimal time to exit your position based on a combination of technical signals. Those with a high risk tolerance may choose to wait and observe market movements over the next few days.

Arizona Metals Corp. (AZMCF) trading strategy for those in sell positions (short positions): If you are in a sell (short) position, holding your position may be the right strategy, as indicated by the consensus of our technical analysis. However, be cautious and monitor market developments closely.

For new positions: If you are not currently invested or considering switching to a sell (short) position, it’s recommended to assess the potential downside of 23.98% based on the lowest expected price range. Ensure that this aligns with your risk tolerance and objectives by conducting thorough research before entering a short position.

In all trading scenarios, a well-defined stop-loss strategy is critical to managing potential downside risks effectively.

Useful Tip: For long-term forecasting, we recommend using the "Predict-price" website, which offers both short-term and long-term predictions at no cost. This resource can support informed decision-making regarding your **Arizona Metals Corp. (AZMCF)** investments.

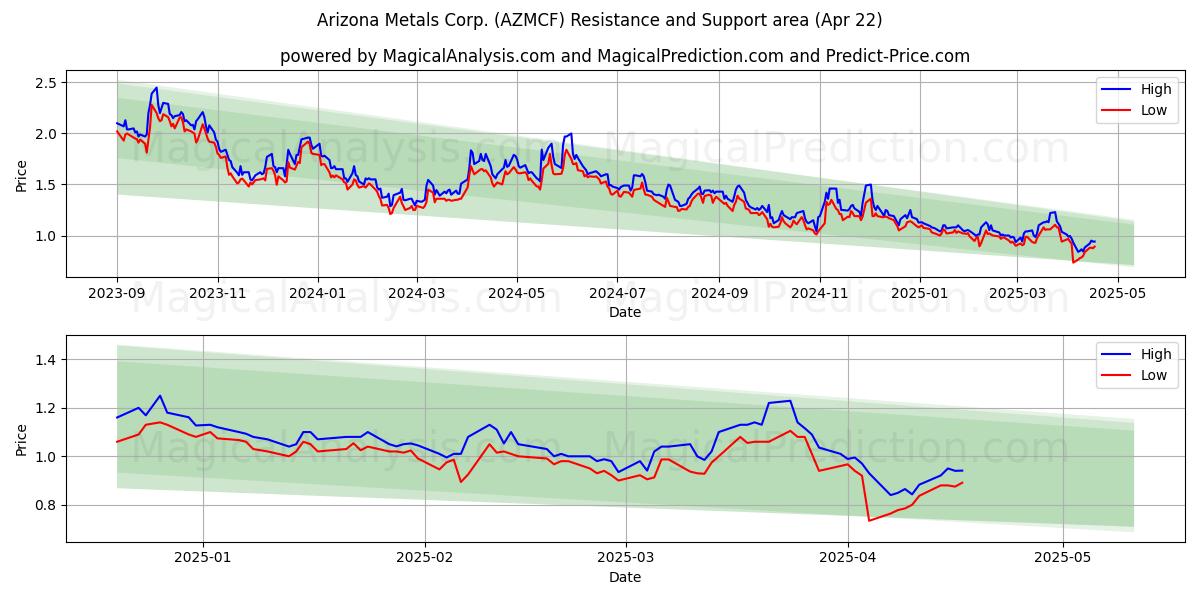

Arizona Metals Corp. (AZMCF) Price Analysis and Support Levels:

In our current Arizona Metals Corp. (AZMCF) position, we find ourselves in a short position, anticipating a potential downward trend. Understanding the key support levels is essential, as these serve as critical reference points for traders and investors to make informed decisions.First Support Level: 0.894

We are closely monitoring the price at 0.894, the first support level. If the downward trend continues, breaching this level would signal strong selling pressure, suggesting the possibility of further price depreciation.

Second Support Level: 0.734

If the first support level is broken, the second support level at 0.734 becomes crucial. A break here would indicate stronger downward momentum, likely driven by market sentiment or external factors.

These support levels should be carefully considered within the context of broader market trends and indicators. By staying alert and consistently analyzing the market, you can make well-informed decisions while trading Arizona Metals Corp. (AZMCF). Keeping these support levels in mind will help you adapt to the dynamic nature of the market and make smarter trading choices.

Arizona Metals Corp. (AZMCF) technical analysis chart

Arizona Metals Corp. (AZMCF) support and resistance levels

| Name | Level1 | Level2 | Level3 | Level4 | Level5 |

|---|---|---|---|---|---|

| Resistance | 1.01 | 1.13 | 1.15 | 1.229 | 1.46 |

| Support | 0.894 | 0.734 | -- | -- | -- |

Arizona Metals Corp. (AZMCF) signals list for 22 Apr

| Overall Signals |

|---|

Arizona Metals Corp. (AZMCF) candlestick patterns on 22 Apr

Arizona Metals Corp. (AZMCF) technical analysis over the past days

| # | Date | Overal Signals | ALL Signals |

|---|

Users forecasts for Arizona Metals Corp. (AZMCF)

What is your prediction?

In this section, you can easily predict without user registration. See also other users predictions.