Free Litium AB (LITI) Technical Analysis Signals

Litium AB (LITI) signal with technical analysis on 19 Feb

DEMA 2DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 1MIDPOINT Slope 2MIDPOINT Slope 3MIDPOINT Slope 4T3 Slope 1T3 Slope 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2AROONOSC 3PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdChaikin AD CrossoverDEMA with ATR 3Volume SpikeKeltner Channel 1Donchian ChannelDaily Pivot Point 1CMO Divergence 1CMO Divergence 2

Hikkake Pattern

Overall Strategy:

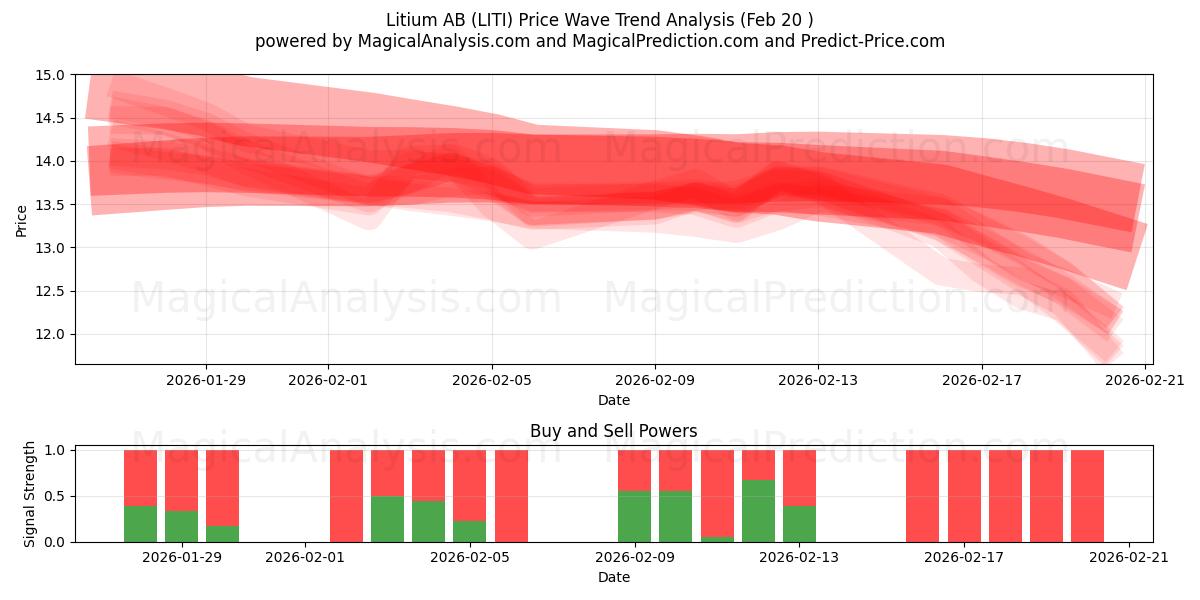

Buy Signals: 1

Sell Signals: 28

Neutral Signals: 70

Result: This strategy leads to a Sell position.

Disclaimer! Please exercise caution and thorough consideration before making any financial decisions. It's important to note that our signals are based solely on daily price changes and do not take into account external factors such as news, market sentiment, or company developments. We strongly recommend considering all relevant factors and conducting your own research.

Useful Tips: To make the most informed decisions about your Litium AB (LITI) investments, we highly recommend visiting the "Magic Prediction" AI models signals website. They provide free signals, and if one aligns with ours, it is likely to be a reliable indicator, as we have observed over time.

Result: Looking at the technical analysis for Litium AB (LITI) on , there is a tendency towards a sell signal based on historical data and analysis. However, it’s crucial to remember that these signals are not guarantees. Make sure to carefully consider overall market conditions and align your decisions with your specific investment goals.

Based on the above signals and forecasts, we recommend the following strategies:

Litium AB (LITI) trading strategy for those in buy positions (long positions): If you are currently in a buy (long) position, it is advisable to identify the optimal time to exit your position based on a combination of technical signals. Those with a high risk tolerance may choose to wait and observe market movements over the next few days.

Litium AB (LITI) trading strategy for those in sell positions (short positions): If you are in a sell (short) position, holding your position may be the right strategy, as indicated by the consensus of our technical analysis. However, be cautious and monitor market developments closely.

For new positions: If you are not currently invested or considering switching to a sell (short) position, it’s recommended to assess the potential downside of 61.64% based on the lowest expected price range. Ensure that this aligns with your risk tolerance and objectives by conducting thorough research before entering a short position.

In all trading scenarios, a well-defined stop-loss strategy is critical to managing potential downside risks effectively.

Useful Tip: For long-term forecasting, we recommend using the "Predict-price" website, which offers both short-term and long-term predictions at no cost. This resource can support informed decision-making regarding your **Litium AB (LITI)** investments.

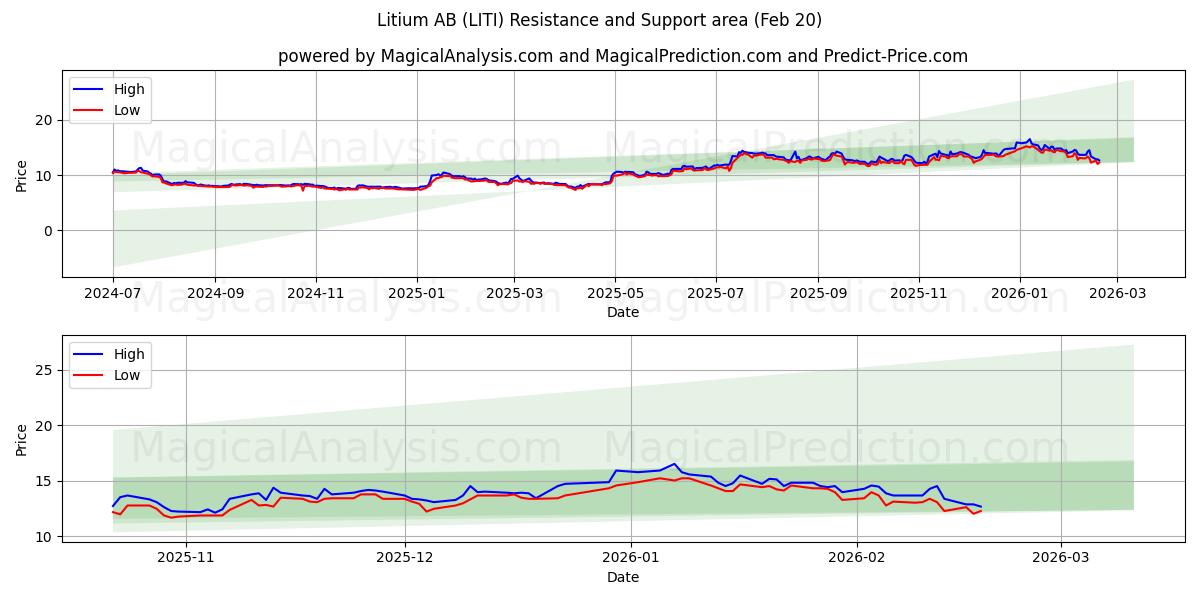

Litium AB (LITI) Price Analysis and Support Levels:

In our current Litium AB (LITI) position, we find ourselves in a short position, anticipating a potential downward trend. Understanding the key support levels is essential, as these serve as critical reference points for traders and investors to make informed decisions.First Support Level: 10.45

We are closely monitoring the price at 10.45, the first support level. If the downward trend continues, breaching this level would signal strong selling pressure, suggesting the possibility of further price depreciation.

Second Support Level: 7.3

If the first support level is broken, the second support level at 7.3 becomes crucial. A break here would indicate stronger downward momentum, likely driven by market sentiment or external factors.

These support levels should be carefully considered within the context of broader market trends and indicators. By staying alert and consistently analyzing the market, you can make well-informed decisions while trading Litium AB (LITI). Keeping these support levels in mind will help you adapt to the dynamic nature of the market and make smarter trading choices.

Litium AB (LITI) technical analysis chart

Litium AB (LITI) support and resistance levels

| Name | Level1 | Level2 | Level3 | Level4 | Level5 |

|---|---|---|---|---|---|

| Resistance | 13.65 | 14.25 | 14.4 | -- | -- |

| Support | 10.45 | 7.3 | -- | -- | -- |

Litium AB (LITI) signals list for 19 Feb

| Overall Signals |

|---|

Litium AB (LITI) candlestick patterns on 19 Feb

Litium AB (LITI) technical analysis over the past days

| # | Date | Overal Signals | ALL Signals |

|---|---|---|---|

| 1 | 19 Feb | S | DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 2MIDPOINT Slope 3MIDPOINT Slope 4T3 Slope 1TEMA Price 3TRIMA Slope 1TRIMA Slope 2PLUS_DI Threshold 1PLUS_DI Threshold 2WILLR Exit OversoldWILLR Exit OverboughtBOP Smoothed ThresholdCMO Divergence 1 |

| 2 | 18 Feb | S | DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 1MIDPOINT Slope 4T3 Slope 1TEMA Price 3TRIMA Slope 1AROONOSC 1PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdChaikin AD CrossoverChaikin ADOSC Zero CrossHammer / Hanging ManVolume SpikeCMO Divergence 1 |

| 3 | 17 Feb | S | DEMA 2DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 1T3 Slope 1TEMA Price 2TEMA Price 3TRIMA Slope 1PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdBBANDS Breakout 2 |

| 4 | 16 Feb | S | DEMA 1DEMA 2DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4EMA Crossover 1EMA Crossover 4WMA Crossover 1WMA Crossover 2MIDPOINT Slope 1MIDPOINT Slope 2MIDPOINT Slope 3MIDPOINT Slope 4TEMA Price 1TEMA Price 2TEMA Price 3SAR CrossoverPLUS_DI Threshold 1PLUS_DI Threshold 2ROCR Threshold 1WILLR Exit OversoldWILLR Exit OverboughtBOP Smoothed ThresholdMACD Crossover 1STOCH Normal Zone CrossChaikin AD CrossoverChaikin ADOSC Zero CrossVolume SpikeDonchian ChannelDaily Pivot Point 1CMO Divergence 1 |

| 5 | 13 Feb | S | EMA Price Cross 1EMA Price Cross 2EMA Price Cross 3EMA Price Cross 4KAMA 2KAMA 3KAMA 4WMA Crossover 2MIDPOINT Slope 2TEMA Price 1TEMA Price 3TRIMA Slope 3PLUS_DI Threshold 1ROC Threshold 1Stochastic RSI SignalVolume SpikeIchimoku 3Elder's Force IndexCMO Divergence 2 |

| 6 | 12 Feb | S | DEMA 1DEMA 2EMA Price Cross 1EMA Price Cross 2EMA Price Cross 3EMA Price Cross 4KAMA 1EMA Crossover 1MIDPOINT Slope 1MIDPOINT Slope 2TEMA Price 1TEMA Price 2TEMA Price 3TRIMA Slope 3SAR CrossoverCCI Crossover 2ROCR Threshold 1BOP Smoothed ThresholdMACD Crossover 1Daily Pivot Point 1Elder's Force IndexCMO Divergence 1 |

| 7 | 11 Feb | B | DEMA 3EMA Price Cross 4KAMA 2KAMA 3KAMA 4WMA Crossover 1MIDPOINT Slope 2TRIMA Slope 2TRIMA Slope 3CCI Crossover 1PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdMACD Crossover 1Chaikin ADOSC Zero Cross |

| 8 | 10 Feb | S | KAMA 2KAMA 3KAMA 4TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 3PLUS_DI Threshold 1ROCR Threshold 1BOP Smoothed ThresholdMACD Crossover 1STOCH Normal Zone CrossChaikin AD Crossover |

| 9 | 09 Feb | N | DEMA 1EMA Price Cross 4KAMA 2KAMA 3KAMA 4MIDPOINT Slope 3MIDPOINT Slope 4TEMA Price 1TEMA Price 2TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3CCI Crossover 3PLUS_DI Threshold 1ROCR Threshold 1BBANDS Breakout 2Stochastic RSI Signal |

| 10 | 06 Feb | N | DEMA 1DEMA 2DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4WMA Crossover 1MIDPOINT Slope 1TEMA Price 1TEMA Price 2TEMA Price 3TRIMA Slope 2TRIMA Slope 3WILLR Exit OversoldBOP Smoothed ThresholdSTOCH Normal Zone CrossVolume SpikeDonchian ChannelDaily Pivot Point 1Elder's Force IndexCMO Divergence 1 |

| 11 | 05 Feb | S | DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 4TEMA Price 3TRIMA Slope 2TRIMA Slope 3PLUS_DI Threshold 2ROC Threshold 2WILLR Exit OverboughtBOP Smoothed ThresholdStochastic RSI SignalOBV CrossoverDaily Pivot Point 1Vortex Indicator |

| 12 | 04 Feb | S | EMA Price Cross 4KAMA 2WMA Crossover 1WMA Crossover 4MIDPOINT Slope 4TEMA Price 2TRIMA Slope 1TRIMA Slope 2CCI Crossover 1CCI Crossover 2ADX +DI/-DI CrossoverPLUS_DI Threshold 1PLUS_DI Threshold 2Chaikin AD CrossoverVortex Indicator |

| 13 | 03 Feb | N | DEMA 1EMA Price Cross 4KAMA 2T3 Slope 1T3 Slope 2TEMA Price 1TEMA Price 2TRIMA Slope 1TRIMA Slope 2CCI Crossover 3PLUS_DI Threshold 2RSI Exit OversoldBOP Smoothed ThresholdBBANDS Breakout 2Stochastic RSI SignalOBV CrossoverChaikin AD CrossoverDaily Pivot Point 1Elder's Force Index |

| 14 | 02 Feb | B | DEMA 1DEMA 2DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 1MIDPOINT Slope 2MIDPOINT Slope 3MIDPOINT Slope 4T3 Slope 1T3 Slope 2TEMA Price 1TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2ADX +DI/-DI CrossoverPLUS_DI Threshold 2BOP Smoothed ThresholdOBV CrossoverChaikin ADOSC Zero CrossDonchian ChannelDaily Pivot Point 1Vortex IndicatorCMO Divergence 1 |

| 15 | 30 Jan | S | DEMA 2DEMA 3KAMA 1KAMA 2KAMA 3MIDPOINT Slope 1MIDPOINT Slope 2MIDPOINT Slope 3MIDPOINT Slope 4T3 Slope 1TEMA Price 2TEMA Price 3TRIMA Slope 1AROONOSC 1AROONOSC 3AROONOSC 4MOM Crossover 1PLUS_DI Threshold 1PLUS_DI Threshold 2ROC Threshold 1ROCR Threshold 1ROCR Threshold 2BOP Smoothed ThresholdChaikin AD CrossoverDonchian ChannelElder's Force IndexCMO Divergence 1Schaff Trend Cycle |

| 16 | 29 Jan | S | DEMA 3KAMA 1KAMA 2EMA Crossover 3MIDPOINT Slope 1TEMA Price 3MOM Crossover 1PLUS_DI Threshold 1PLUS_DI Threshold 2ROCR Threshold 4WILLR Exit OversoldWILLR Exit OverboughtBOP Smoothed ThresholdADXR with DI+/DI-Ichimoku 3Daily Pivot Point 1CMO Divergence 1 |

| 17 | 28 Jan | S | DEMA 3KAMA 2MIDPOINT Slope 2MIDPOINT Slope 4T3 Slope 2TEMA Price 3AROONOSC 1AROONOSC 3PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdSTOCH Normal Zone CrossStochastic RSI SignalADXR with DI+/DI- |

| 18 | 27 Jan | N | DEMA 3EMA Price Cross 1EMA Price Cross 2EMA Price Cross 3EMA Price Cross 4KAMA 1KAMA 2MIDPOINT Slope 4T3 Slope 2TEMA Price 1TEMA Price 2TEMA Price 3PLUS_DI Threshold 1PLUS_DI Threshold 2WILLR Exit OversoldWILLR Exit OverboughtBOP Smoothed ThresholdSTOCH Normal Zone CrossADXR with DI+/DI- |

| 19 | 26 Jan | S | EMA Price Cross 1EMA Price Cross 2EMA Price Cross 3EMA Price Cross 4KAMA 3KAMA 4MIDPOINT Slope 1MIDPOINT Slope 3T3 Slope 2TEMA Price 1TEMA Price 2TRIMA Slope 1TRIMA Slope 3PLUS_DI Threshold 1PLUS_DI Threshold 2ROCR Threshold 1BOP Smoothed ThresholdADXR with DI+/DI-Daily Pivot Point 1Elder's Force Index |

| 20 | 23 Jan | B | DEMA 3KAMA 2TEMA Price 3TRIMA Slope 3PLUS_DI Threshold 1PLUS_DI Threshold 2ROC Threshold 2BOP Smoothed ThresholdStochastic RSI SignalOBV CrossoverChaikin AD CrossoverChaikin ADOSC Zero CrossADXR with DI+/DI-Ichimoku 1Coppock Curve |

| 21 | 22 Jan | N | DEMA 1DEMA 2DEMA 3EMA Price Cross 1EMA Price Cross 2EMA Price Cross 3EMA Price Cross 4KAMA 1KAMA 2EMA Crossover 1EMA Crossover 2WMA Crossover 1WMA Crossover 2MIDPOINT Slope 1MIDPOINT Slope 3TEMA Price 1TEMA Price 2TEMA Price 3TRIMA Slope 3AROONOSC 2MOM Crossover 2PLUS_DI Threshold 1PLUS_DI Threshold 2ROCR Threshold 3WILLR Exit OversoldWILLR Exit OverboughtBOP Smoothed ThresholdSTOCH Normal Zone CrossBBANDS Breakout 1Stochastic RSI SignalOBV CrossoverChaikin AD CrossoverChaikin ADOSC Zero CrossEngulfing PatternADXR with DI+/DI-Ichimoku 2Daily Pivot Point 1Rolling VWAPElder's Force IndexCMO Divergence 1 |

| 22 | 21 Jan | S | EMA Price Cross 1EMA Price Cross 2EMA Price Cross 4KAMA 3KAMA 4EMA Crossover 1EMA Crossover 2WMA Crossover 2MIDPOINT Slope 3TEMA Price 2TRIMA Slope 1TRIMA Slope 2PLUS_DI Threshold 1PLUS_DI Threshold 2ROCR Threshold 1BOP Smoothed ThresholdPercentage Price OscillatorChaikin AD CrossoverADXR with DI+/DI-Ichimoku 3Daily Pivot Point 1Rolling VWAPCMO Divergence 1 |

| 23 | 20 Jan | B | EMA Price Cross 1EMA Price Cross 2EMA Price Cross 4WMA Crossover 3TEMA Price 3TRIMA Slope 2PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdStochastic RSI SignalChaikin ADOSC Zero CrossHammer / Hanging ManADXR with DI+/DI-Rolling VWAPCMO Divergence 2 |

| 24 | 19 Jan | S | DEMA 1EMA Price Cross 1EMA Price Cross 2EMA Price Cross 3EMA Price Cross 4KAMA 4WMA Crossover 1MIDPOINT Slope 2TEMA Price 1TEMA Price 2TRIMA Slope 2MOM Crossover 1PLUS_DI Threshold 1PLUS_DI Threshold 2ROC Threshold 1ROCR Threshold 2TRIX Crossover 2BOP Smoothed ThresholdSTOCH Normal Zone CrossADXR with DI+/DI-Ichimoku 3Daily Pivot Point 1Rolling VWAPCMO Divergence 1 |

| 25 | 16 Jan | B | T3 Slope 1TEMA Price 1TEMA Price 3TRIMA Slope 1TRIMA Slope 2PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdBBANDS Breakout 1Stochastic RSI SignalOBV CrossoverEngulfing PatternIchimoku 2Daily Pivot Point 1Elder's Force Index |

| 26 | 15 Jan | B | DEMA 2DEMA 3EMA Price Cross 3EMA Crossover 2MIDPOINT Slope 1MIDPOINT Slope 2TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 3MOM Crossover 1PLUS_DI Threshold 1PLUS_DI Threshold 2ROC Threshold 1ROCR Threshold 2TRIX Crossover 1WILLR Exit OversoldBOP Smoothed ThresholdBBANDS Breakout 1Chaikin ADOSC Zero CrossIchimoku 2Daily Pivot Point 1CMO Divergence 1 |

| 27 | 14 Jan | S | DEMA 2MIDPOINT Slope 3TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 3SAR CrossoverAROONOSC 1AROONOSC 3PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdMACD Crossover 2OBV CrossoverElder's Force IndexCMO Divergence 1 |

| 28 | 13 Jan | S | DEMA 1DEMA 2EMA Price Cross 1EMA Price Cross 2EMA Price Cross 4KAMA 1KAMA 4EMA Crossover 1WMA Crossover 2MIDPOINT Slope 1MIDPOINT Slope 3TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3PLUS_DI Threshold 1PLUS_DI Threshold 2ROCR Threshold 1BOP Smoothed ThresholdMoney Flow IndexChaikin AD CrossoverVolume SpikeADXR with DI+/DI-Daily Pivot Point 1Rolling VWAPCMO Divergence 1 |

| 29 | 12 Jan | S | EMA Price Cross 4KAMA 3KAMA 4TEMA Price 2TRIMA Slope 2TRIMA Slope 3CCI Crossover 2PLUS_DI Threshold 1PLUS_DI Threshold 2MACD Crossover 1ADXR with DI+/DI- |

| 30 | 09 Jan | B | DEMA 1EMA Price Cross 4KAMA 3KAMA 4WMA Crossover 1T3 Slope 2TEMA Price 2TEMA Price 3TRIMA Slope 2TRIMA Slope 3CCI Crossover 1CCI Crossover 3PLUS_DI Threshold 1PLUS_DI Threshold 2RSI Exit OversoldRSI Exit OverboughtBOP Smoothed ThresholdADXR with DI+/DI-CMO Divergence 1 |

Users forecasts for Litium AB (LITI)

What is your prediction?

In this section, you can easily predict without user registration. See also other users predictions.