Free Vienna Insurance Group (VIG) Technical Analysis Signals

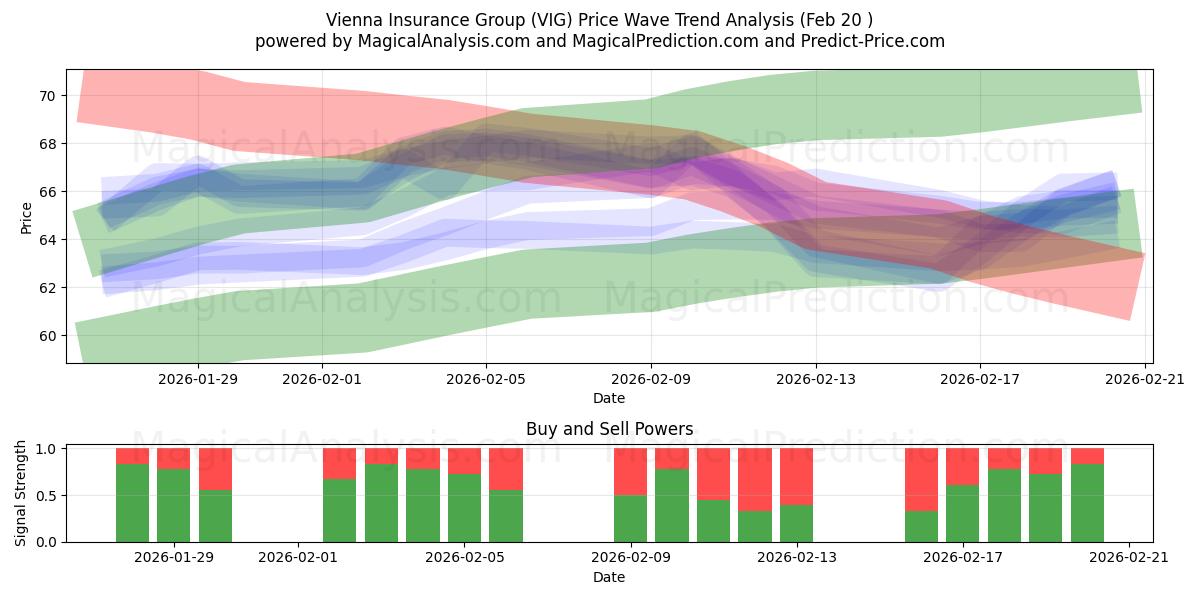

Vienna Insurance Group (VIG) signal with technical analysis on 19 Feb

WMA Crossover 2TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 3PLUS_DI Threshold 1PLUS_DI Threshold 2ROCR Threshold 1ROCR Threshold 3BOP Smoothed ThresholdCMO Divergence 1

Doji Up/Down-gap side-by-side white lines High-Wave Candle Long Legged Doji Rickshaw Man Spinning Top

Overall Strategy:

Buy Signals: 7

Sell Signals: 6

Neutral Signals: 86

Result: This strategy leads to a Neutral position.

Disclaimer! Please exercise caution and thorough consideration before making any financial decisions. It's important to note that our signals are based solely on daily price changes and do not take into account external factors such as news, market sentiment, or company developments. We strongly recommend considering all relevant factors and conducting your own research.

Useful Tips: To make the most informed decisions about your Vienna Insurance Group (VIG) investments, we highly recommend visiting the "Magic Prediction" AI models signals website. They provide free signals, and if one aligns with ours, it is likely to be a reliable indicator, as we have observed over time.

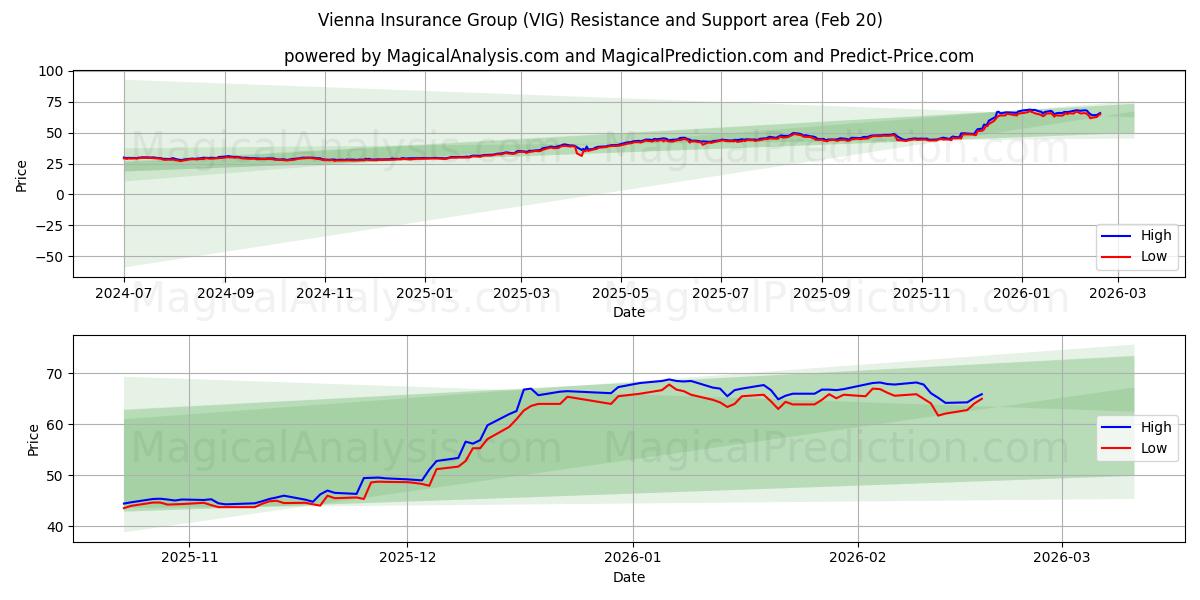

Second Support Level: 43

If the first support level is breached, the second support level at 43 becomes a critical point. Breaking this level would indicate stronger downward momentum, likely driven by market sentiment or external factors.

Third Support Level: 40.533

If the second support level is broken and the price continues to fall, it signals a significant market shift. Remaining below 40.533 would confirm a persistent downward trend, with traders likely targeting this third level as the next key support point.

These support levels should be considered carefully in the context of broader market trends and indicators. Staying alert and consistently analyzing the market will allow you to make informed decisions while trading Vienna Insurance Group (VIG). Paying attention to these support levels will help you adapt to the dynamic nature of the market and make smarter trading choices. Second Resistance Level: 68.8

If the upward trend continues with significant strength, we may see Vienna Insurance Group (VIG) cross the second resistance level at 68.8. This would indicate a major upside move and a promising direction for our position.

It's crucial to closely monitor these resistance levels and consider them in the context of broader market trends and indicators. To make informed decisions when trading Vienna Insurance Group (VIG), stay vigilant and continuously analyze the market. Focusing on these resistance levels, along with broader market dynamics, will help you make smarter trading decisions and adapt to the changing market conditions.

Vienna Insurance Group (VIG) technical analysis chart

Vienna Insurance Group (VIG) support and resistance levels

| Name | Level1 | Level2 | Level3 | Level4 | Level5 |

|---|---|---|---|---|---|

| Resistance | 67.7 | 68.8 | -- | -- | -- |

| Support | 49.7 | 43 | 40.533 | -- | -- |

Vienna Insurance Group (VIG) signals list for 19 Feb

| Overall Signals |

|---|

Vienna Insurance Group (VIG) candlestick patterns on 19 Feb

Vienna Insurance Group (VIG) technical analysis over the past days

| # | Date | Overal Signals | ALL Signals |

|---|---|---|---|

| 1 | 19 Feb | N | EMA Price Cross 2EMA Price Cross 3EMA Crossover 1MIDPOINT Slope 1T3 Slope 2TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2PLUS_DI Threshold 1PLUS_DI Threshold 2ROCR Threshold 4BOP Smoothed ThresholdMACD Crossover 1CMO Divergence 1 |

| 2 | 18 Feb | B | DEMA 1EMA Price Cross 1EMA Price Cross 4WMA Crossover 1WMA Crossover 4T3 Slope 2TEMA Price 1TEMA Price 2TEMA Price 3TRIMA Slope 2CCI Crossover 1CCI Crossover 2PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdChaikin AD CrossoverIchimoku 2Ichimoku 3Daily Pivot Point 1CMO Divergence 1 |

| 3 | 17 Feb | B | DEMA 1DEMA 3KAMA 3MIDPOINT Slope 2T3 Slope 1T3 Slope 2TEMA Price 1TEMA Price 2TRIMA Slope 1TRIMA Slope 2CCI Crossover 3PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdSTOCH Normal Zone CrossBBANDS Breakout 2Stochastic RSI SignalPercentage Price OscillatorDaily Pivot Point 1 |

| 4 | 16 Feb | N | DEMA 2DEMA 3KAMA 2KAMA 3KAMA 4EMA Crossover 3T3 Slope 1T3 Slope 2TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2PLUS_DI Threshold 1PLUS_DI Threshold 2ROC Threshold 2BOP Smoothed ThresholdChaikin AD CrossoverCMO Divergence 1Coppock Curve |

| 5 | 13 Feb | S | DEMA 1DEMA 2DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4WMA Crossover 3MIDPOINT Slope 1MIDPOINT Slope 2MIDPOINT Slope 3MIDPOINT Slope 4T3 Slope 1TEMA Price 2TEMA Price 3TRIMA Slope 1AROONOSC 1PLUS_DI Threshold 1PLUS_DI Threshold 2ROCR Threshold 4WILLR Exit OverboughtBOP Smoothed ThresholdVolume SpikeDonchian ChannelIchimoku 1Daily Pivot Point 1CMO Divergence 1CMO Divergence 2 |

| 6 | 12 Feb | S | DEMA 1DEMA 2DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4EMA Crossover 2MIDPOINT Slope 1MIDPOINT Slope 2MIDPOINT Slope 3T3 Slope 1TEMA Price 2TEMA Price 3TRIMA Slope 1SAR CrossoverMOM Crossover 2PLUS_DI Threshold 1PLUS_DI Threshold 2ROC Threshold 1ROCR Threshold 3WILLR Exit OversoldBOP Smoothed ThresholdIchimoku 2CMO Divergence 1 |

| 7 | 11 Feb | S | DEMA 1DEMA 2DEMA 3EMA Price Cross 1EMA Price Cross 2EMA Price Cross 3EMA Price Cross 4KAMA 1EMA Crossover 1WMA Crossover 2TEMA Price 1TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 3CCI Crossover 2MOM Crossover 1PLUS_DI Threshold 1PLUS_DI Threshold 2ROCR Threshold 1ROCR Threshold 2TRIX Crossover 1BOP Smoothed ThresholdMACD Crossover 1BBANDS Breakout 1Ultimate OscillatorOBV CrossoverDaily Pivot Point 1Rolling VWAPVortex IndicatorElder's Force IndexCMO Divergence 1 |

| 8 | 10 Feb | S | EMA Price Cross 1EMA Price Cross 2EMA Price Cross 4KAMA 1KAMA 2KAMA 3KAMA 4EMA Crossover 1MIDPOINT Slope 3MIDPOINT Slope 4T3 Slope 2TEMA Price 1TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3MOM Crossover 2PLUS_DI Threshold 1ROC Threshold 2ROCR Threshold 3ROCR Threshold 4WILLR Exit OversoldWILLR Exit OverboughtBOP Smoothed ThresholdMACD Crossover 1BBANDS Breakout 1Stochastic RSI SignalPercentage Price OscillatorOBV CrossoverEngulfing PatternIchimoku 3Daily Pivot Point 1Elder's Force IndexCMO Divergence 1CMO Divergence 2 |

| 9 | 09 Feb | B | DEMA 1DEMA 2DEMA 3EMA Price Cross 1EMA Price Cross 2EMA Price Cross 4EMA Crossover 1WMA Crossover 1MIDPOINT Slope 1MIDPOINT Slope 3TEMA Price 1TEMA Price 2TEMA Price 3TRIMA Slope 2MOM Crossover 2PLUS_DI Threshold 1ROCR Threshold 3BOP Smoothed ThresholdMACD Crossover 1BBANDS Breakout 1Ultimate OscillatorOBV CrossoverDaily Pivot Point 1Elder's Force IndexCMO Divergence 1 |

| 10 | 06 Feb | S | KAMA 4MIDPOINT Slope 4TEMA Price 3TRIMA Slope 1TRIMA Slope 2CCI Crossover 1CCI Crossover 2CCI Crossover 3PLUS_DI Threshold 1ROCR Threshold 4Stochastic RSI SignalEngulfing PatternSchaff Trend Cycle |

| 11 | 05 Feb | S | KAMA 2KAMA 4MIDPOINT Slope 1T3 Slope 1TEMA Price 3TRIMA Slope 1TRIMA Slope 2BOP Smoothed Threshold |

| 12 | 04 Feb | B | KAMA 2KAMA 3KAMA 4MIDPOINT Slope 1MIDPOINT Slope 3MIDPOINT Slope 4T3 Slope 1TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2ROC Threshold 1ROCR Threshold 2BOP Smoothed ThresholdHammer / Hanging ManIchimoku 1CMO Divergence 1Coppock Curve |

| 13 | 03 Feb | B | DEMA 1DEMA 2KAMA 1KAMA 2KAMA 3KAMA 4WMA Crossover 1WMA Crossover 3MIDPOINT Slope 1MIDPOINT Slope 2MIDPOINT Slope 3T3 Slope 1TEMA Price 1TEMA Price 2TEMA Price 3SAR CrossoverAROONOSC 2AROONOSC 4MOM Crossover 1MOM Crossover 2ROC Threshold 2ROCR Threshold 3WILLR Exit OversoldWILLR Exit OverboughtBOP Smoothed ThresholdBBANDS Breakout 1Engulfing PatternDaily Pivot Point 1CMO Divergence 1 |

| 14 | 02 Feb | B | DEMA 3EMA Price Cross 1EMA Price Cross 2EMA Price Cross 4WMA Crossover 1MIDPOINT Slope 2T3 Slope 1TEMA Price 2TRIMA Slope 1PLUS_DI Threshold 1ROCR Threshold 1Ichimoku 2Rolling VWAP |

| 15 | 30 Jan | B | DEMA 3EMA Price Cross 1EMA Price Cross 2EMA Price Cross 4T3 Slope 1TEMA Price 1TRIMA Slope 1AROONOSC 1AROONOSC 3MOM Crossover 1PLUS_DI Threshold 1ROCR Threshold 2ROCR Threshold 4BOP Smoothed ThresholdBBANDS Breakout 1Stochastic RSI SignalIchimoku 2Rolling VWAP |

| 16 | 29 Jan | S | EMA Crossover 2WMA Crossover 2MIDPOINT Slope 1T3 Slope 1TEMA Price 2TEMA Price 3TRIMA Slope 1ROC Threshold 2ROCR Threshold 3BOP Smoothed ThresholdIchimoku 1 |

| 17 | 28 Jan | B | DEMA 1EMA Price Cross 1EMA Price Cross 2EMA Crossover 1MIDPOINT Slope 1MIDPOINT Slope 2TEMA Price 1TEMA Price 2TEMA Price 3MOM Crossover 1ROC Threshold 1ROCR Threshold 1ROCR Threshold 2ROCR Threshold 4WILLR Exit OversoldBOP Smoothed ThresholdMACD Crossover 1BBANDS Breakout 1Daily Pivot Point 1Rolling VWAPCMO Divergence 1 |

| 18 | 27 Jan | B | DEMA 3EMA Price Cross 3EMA Price Cross 4KAMA 3WMA Crossover 1MIDPOINT Slope 2TEMA Price 1TEMA Price 2TEMA Price 3TRIMA Slope 1CCI Crossover 2ROCR Threshold 4BOP Smoothed ThresholdSTOCH Normal Zone CrossStochastic RSI SignalEngulfing PatternIchimoku 3Elder's Force Index |

| 19 | 26 Jan | B | DEMA 2DEMA 3EMA Price Cross 3EMA Price Cross 4KAMA 1KAMA 2KAMA 3KAMA 4T3 Slope 2TEMA Price 3TRIMA Slope 1PLUS_DI Threshold 2WILLR Exit OverboughtBOP Smoothed ThresholdDaily Pivot Point 1Elder's Force IndexCMO Divergence 1 |

| 20 | 23 Jan | S | DEMA 3EMA Price Cross 3EMA Price Cross 4MIDPOINT Slope 1MIDPOINT Slope 3T3 Slope 2TEMA Price 1TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 3CCI Crossover 1CCI Crossover 2CCI Crossover 3PLUS_DI Threshold 2ROCR Threshold 1ROCR Threshold 4BOP Smoothed ThresholdStochastic RSI SignalHammer / Hanging ManElder's Force Index |

| 21 | 22 Jan | B | DEMA 1DEMA 2DEMA 3EMA Price Cross 3KAMA 1KAMA 2KAMA 3KAMA 4EMA Crossover 2WMA Crossover 1WMA Crossover 2MIDPOINT Slope 1T3 Slope 2TEMA Price 1TEMA Price 2TEMA Price 3SAR CrossoverAROONOSC 4MOM Crossover 2PLUS_DI Threshold 2ROC Threshold 2ROCR Threshold 3ROCR Threshold 4BOP Smoothed ThresholdSTOCH Normal Zone CrossDaily Pivot Point 1Elder's Force IndexCMO Divergence 1Coppock Curve |

| 22 | 21 Jan | S | DEMA 2DEMA 3EMA Price Cross 1EMA Price Cross 2EMA Price Cross 4EMA Crossover 1WMA Crossover 2TEMA Price 1TEMA Price 3TRIMA Slope 1TRIMA Slope 2PLUS_DI Threshold 2ROC Threshold 1BBANDS Breakout 1Stochastic RSI SignalDaily Pivot Point 1Rolling VWAP |

| 23 | 20 Jan | S | DEMA 3MIDPOINT Slope 1TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2SAR CrossoverPLUS_DI Threshold 1PLUS_DI Threshold 2ROC Threshold 2ROCR Threshold 3BOP Smoothed ThresholdDaily Pivot Point 1CMO Divergence 1 |

| 24 | 19 Jan | B | DEMA 3EMA Crossover 1EMA Crossover 2WMA Crossover 1WMA Crossover 3MIDPOINT Slope 4TEMA Price 1TEMA Price 2TEMA Price 3TRIMA Slope 2PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdSTOCH Normal Zone CrossADXR with DI+/DI- |

| 25 | 16 Jan | B | DEMA 1DEMA 3EMA Price Cross 1EMA Price Cross 2EMA Price Cross 4MIDPOINT Slope 2MIDPOINT Slope 4T3 Slope 1TEMA Price 1TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2CCI Crossover 1CCI Crossover 3MOM Crossover 2PLUS_DI Threshold 1PLUS_DI Threshold 2ROC Threshold 2ROCR Threshold 3BOP Smoothed ThresholdBBANDS Breakout 1Stochastic RSI SignalMorning/Evening StarADXR with DI+/DI-Daily Pivot Point 1 |

| 26 | 15 Jan | B | DEMA 1DEMA 2DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4EMA Crossover 2MIDPOINT Slope 1MIDPOINT Slope 2T3 Slope 1TEMA Price 2TEMA Price 3TRIMA Slope 1AROONOSC 2PLUS_DI Threshold 1PLUS_DI Threshold 2ROC Threshold 1WILLR Exit OversoldWILLR Exit OverboughtBOP Smoothed ThresholdBBANDS Breakout 1CMO Divergence 1CMO Divergence 2 |

| 27 | 14 Jan | S | DEMA 1DEMA 2DEMA 3EMA Price Cross 1EMA Price Cross 2KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 1MIDPOINT Slope 2T3 Slope 1TEMA Price 1TEMA Price 2TEMA Price 3TRIMA Slope 1MOM Crossover 1MOM Crossover 2PLUS_DI Threshold 1PLUS_DI Threshold 2ROC Threshold 2ROCR Threshold 2ROCR Threshold 3BOP Smoothed ThresholdUltimate OscillatorADXR with DI+/DI-Daily Pivot Point 1CMO Divergence 1 |

| 28 | 13 Jan | S | DEMA 2DEMA 3KAMA 2WMA Crossover 2MIDPOINT Slope 4TEMA Price 2TEMA Price 3TRIMA Slope 3AROONOSC 1AROONOSC 3PLUS_DI Threshold 1PLUS_DI Threshold 2ADXR with DI+/DI-CMO Divergence 2 |

| 29 | 12 Jan | N | DEMA 1DEMA 2DEMA 3EMA Price Cross 4EMA Crossover 1TEMA Price 1TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3PLUS_DI Threshold 1PLUS_DI Threshold 2ROCR Threshold 1RSI Exit OversoldRSI Exit OverboughtBOP Smoothed ThresholdEngulfing PatternADXR with DI+/DI-Daily Pivot Point 1CMO Divergence 1CMO Divergence 2 |

| 30 | 09 Jan | S | DEMA 2EMA Price Cross 4KAMA 1KAMA 2KAMA 3KAMA 4WMA Crossover 1TEMA Price 3TRIMA Slope 2TRIMA Slope 3SAR CrossoverCMO Crossover 1PLUS_DI Threshold 1PLUS_DI Threshold 2ROC Threshold 1TRIX Crossover 2WILLR Exit OversoldBOP Smoothed ThresholdMACD Crossover 2Stochastic RSI SignalPercentage Price OscillatorADXR with DI+/DI-Daily Pivot Point 1 |

Users forecasts for Vienna Insurance Group (VIG)

What is your prediction?

In this section, you can easily predict without user registration. See also other users predictions.