Free Trading Signals by Technical Analysis

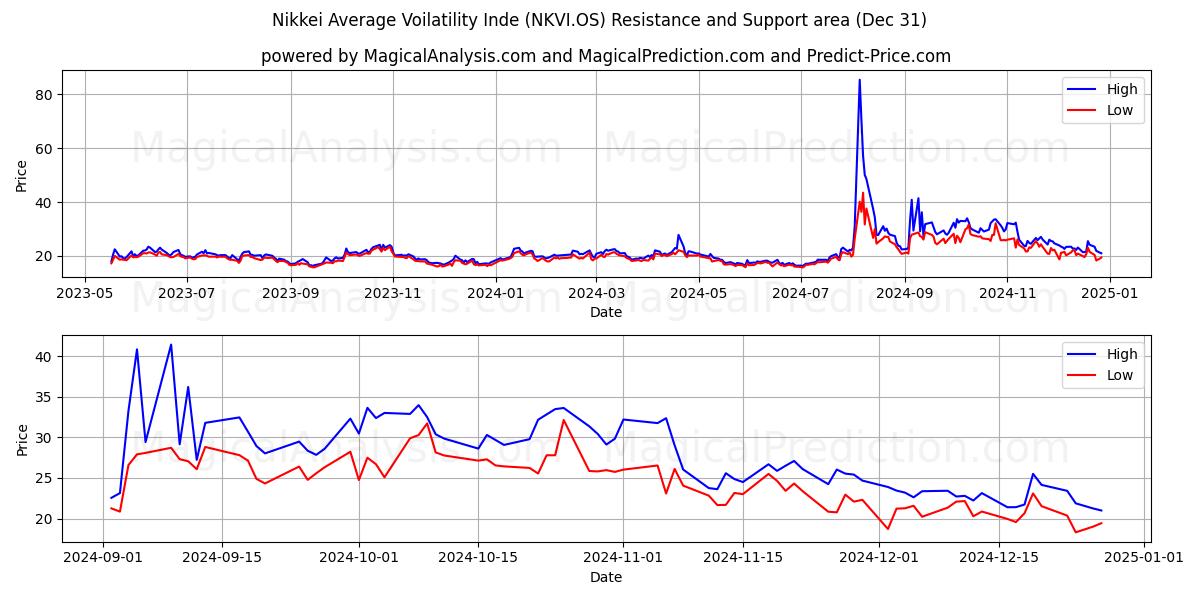

Nikkei Average Voilatility Inde (NKVI.OS) Hold Signal for 31 Dec Based on Technical Analysis

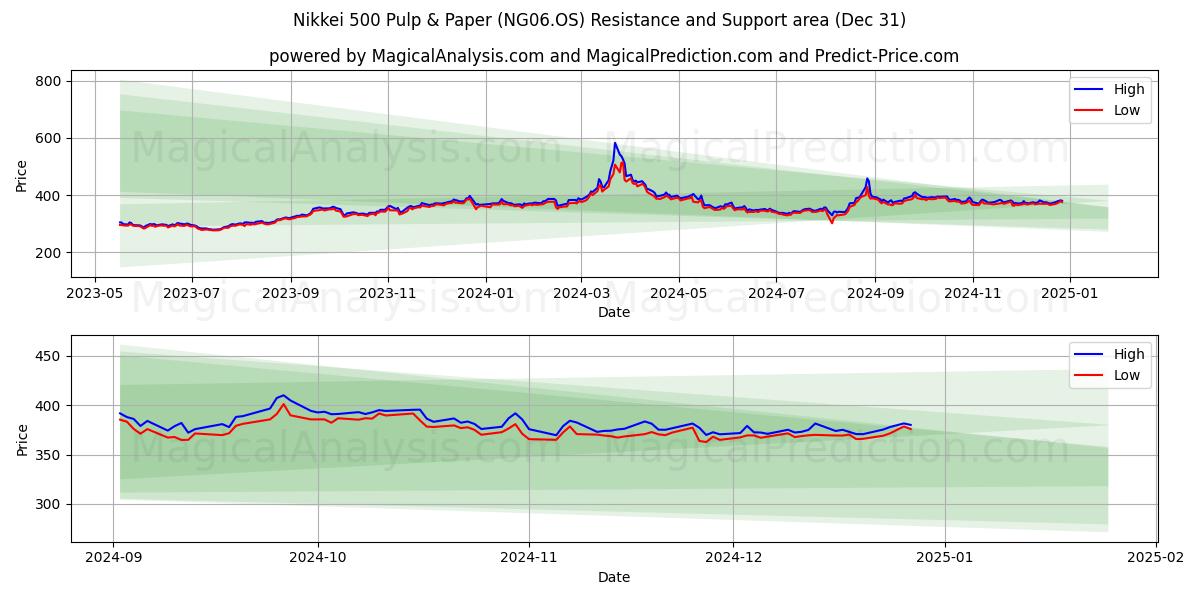

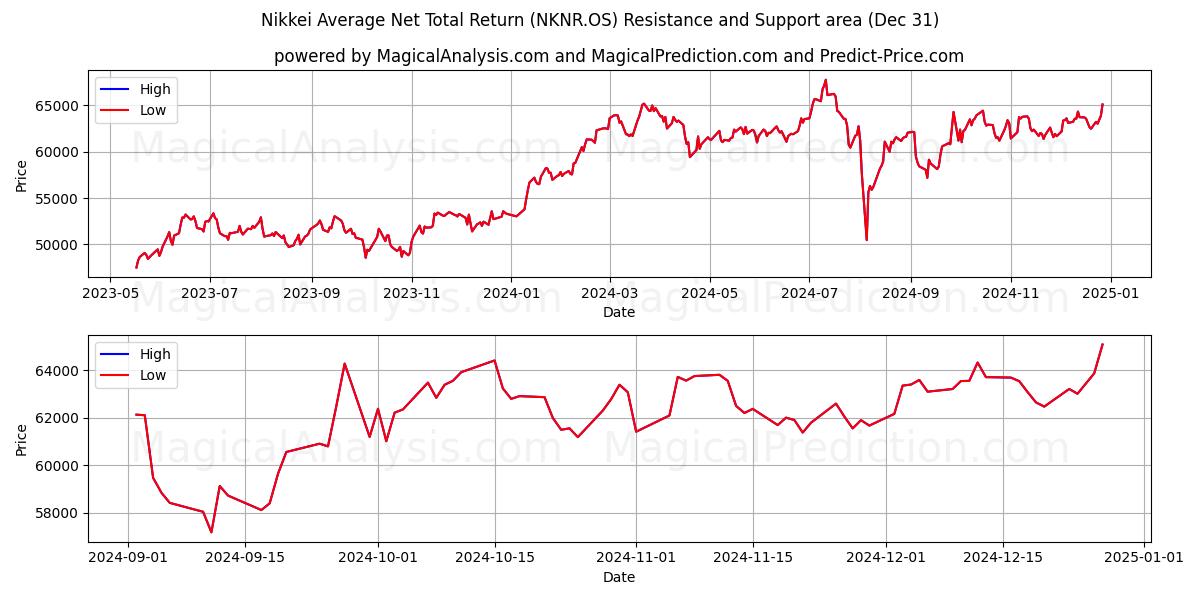

Nikkei Average Net Total Return (NKNR.OS) Hold Signal for 31 Dec Based on Technical Analysis

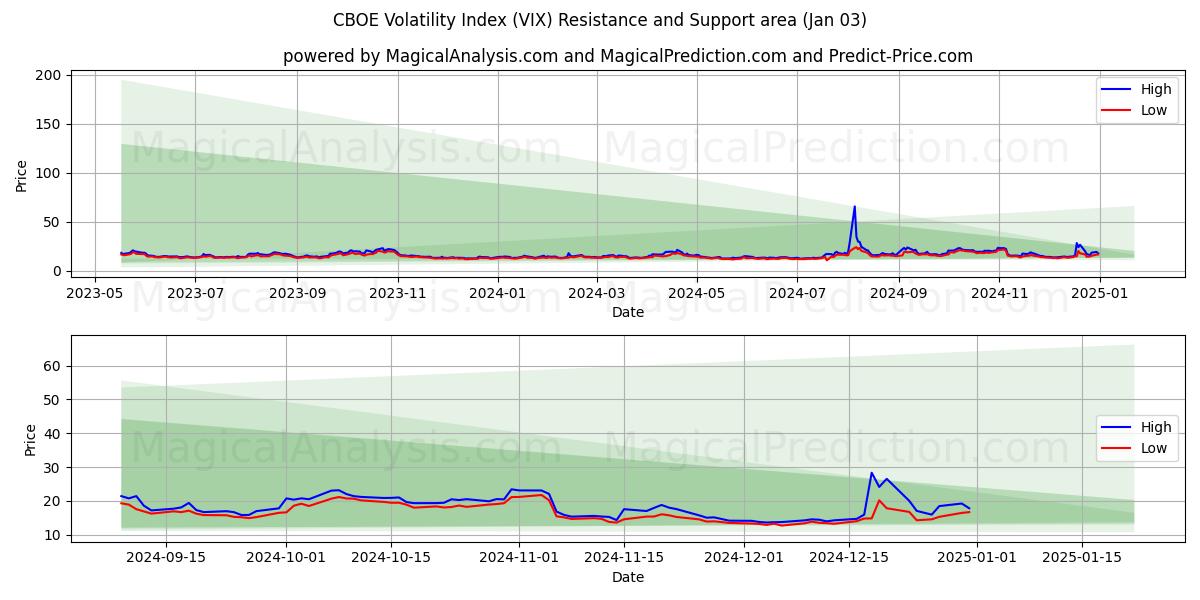

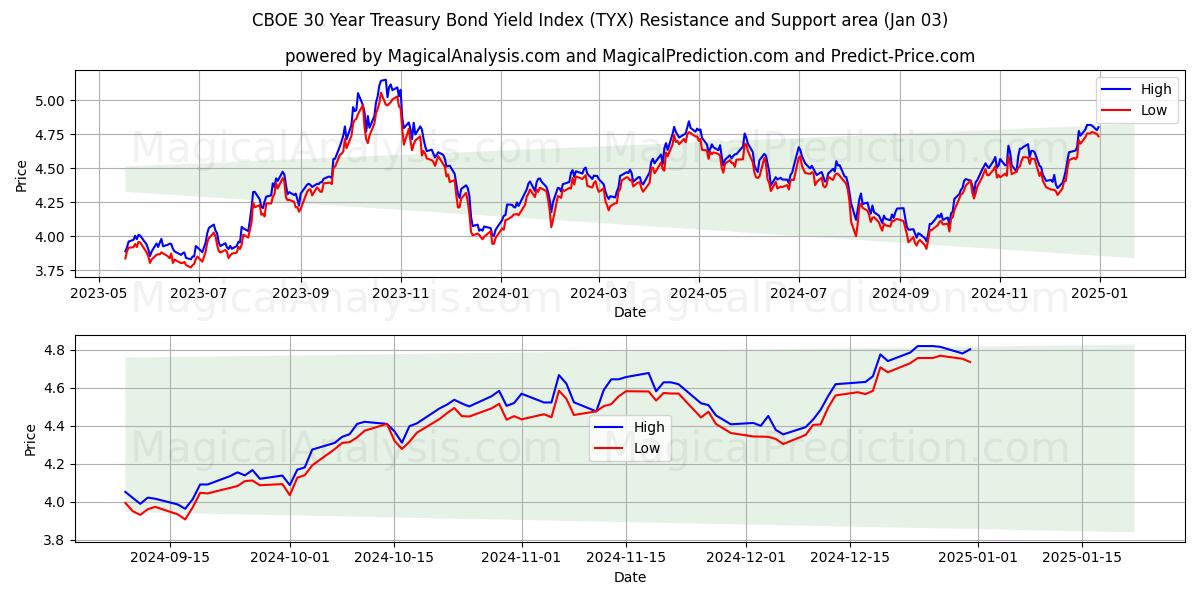

CBOE 30 Year Treasury Bond Yield Index (TYX) Hold Signal for 03 Jan Based on Technical Analysis

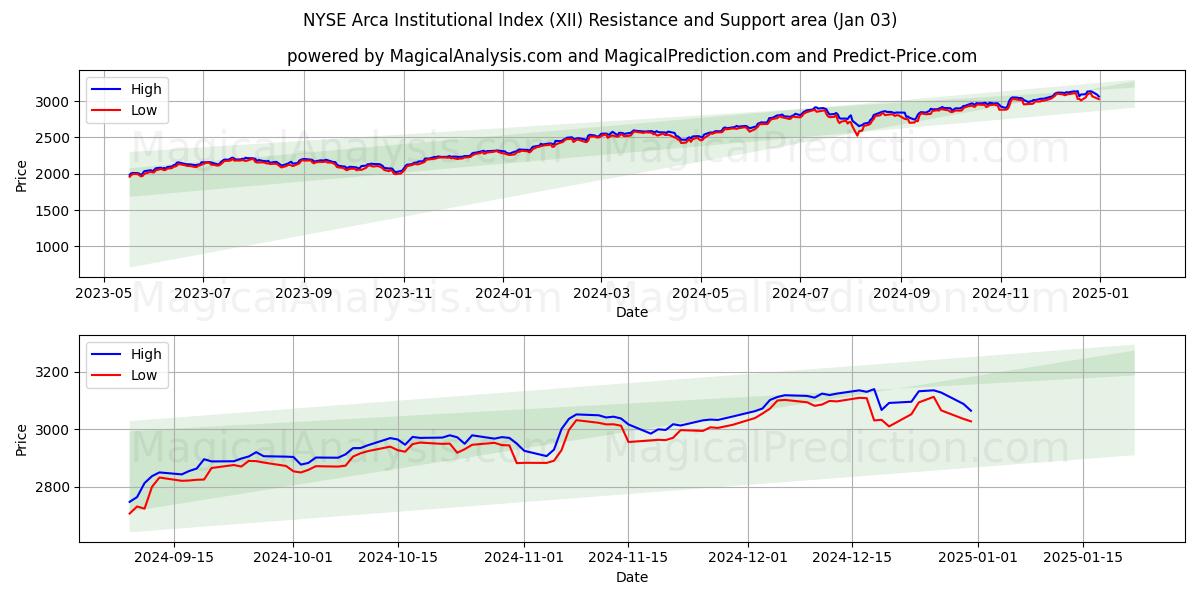

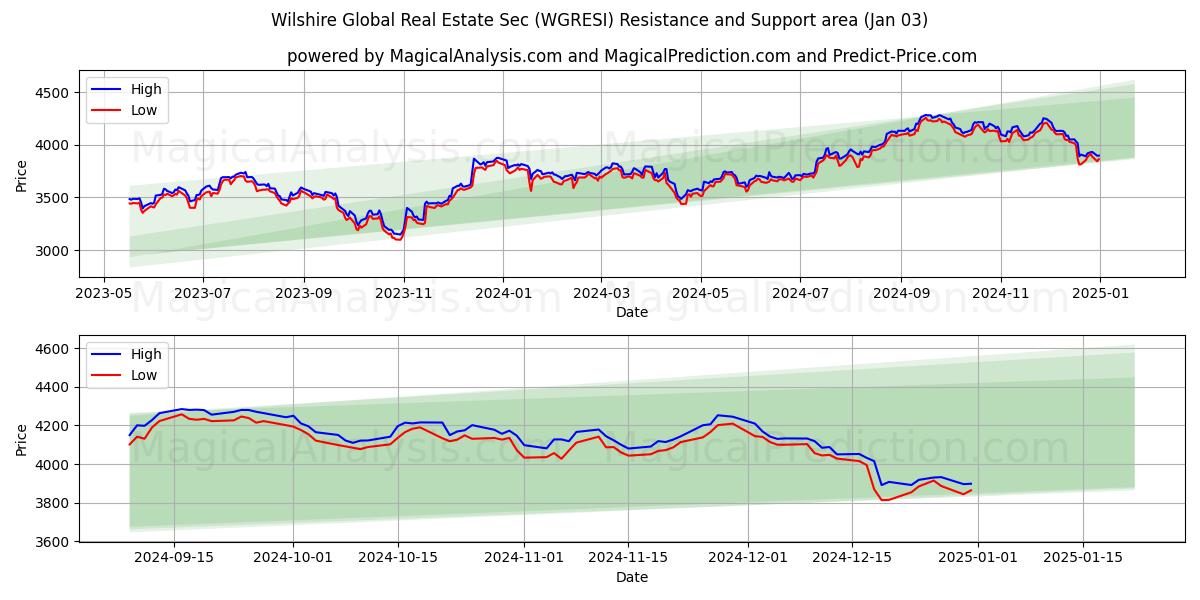

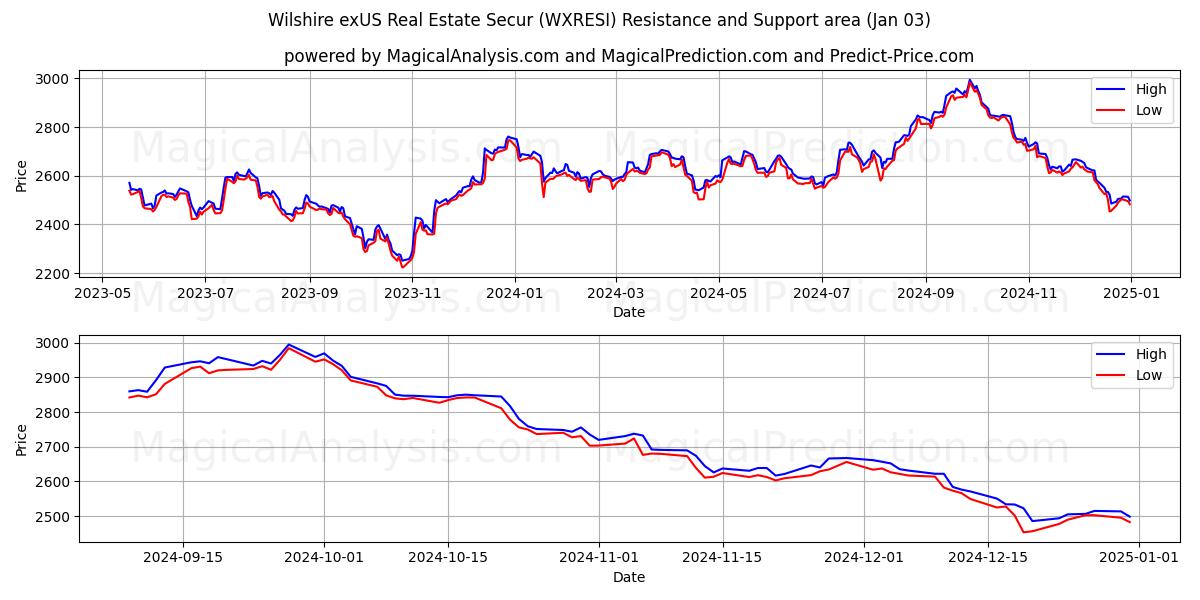

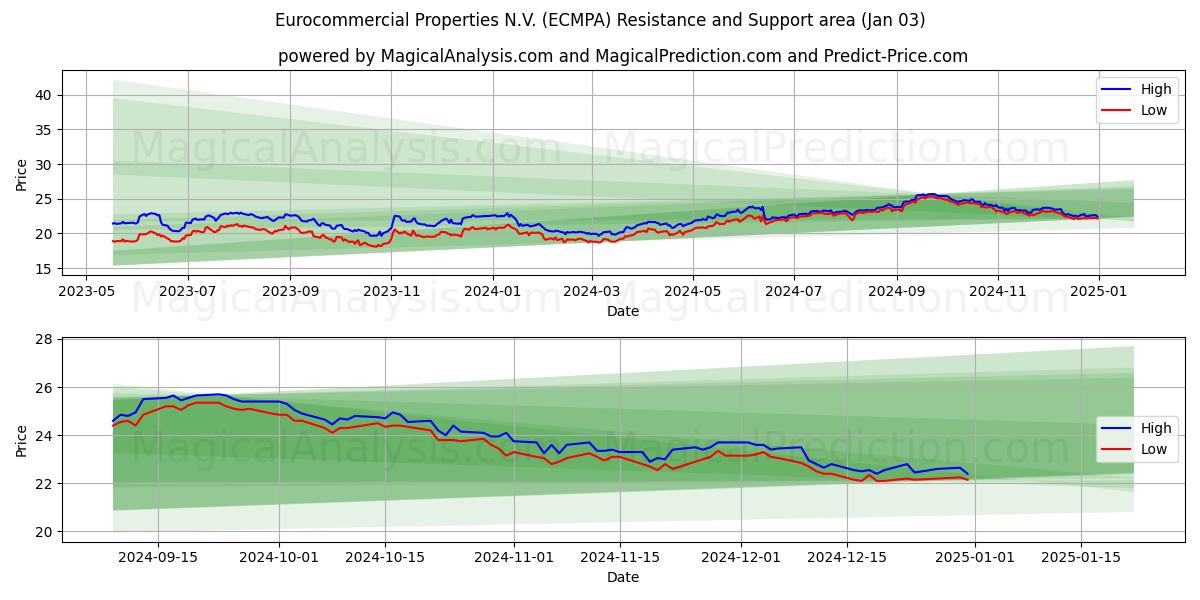

Wilshire Global Real Estate Sec (WGRESI) Sell Signal for 03 Jan Based on Technical Analysis