Gratis S&P 500 INDEX CONSUMER STAPLES (E-MINI) (XAP) Teknisk Analyse Signaler

S&P 500 INDEX CONSUMER STAPLES (E-MINI) (XAP) signal med teknisk analyse på 23 Feb

De 256 signalene ble kategorisert i fire distinkte strategier, hver bestående av 64 signaler. La oss gå dypere inn i detaljene for hver strategi:

Strategi 1:

Kjøpssignaler:

Salgsignaler:

Nøytrale signaler:

Resultat: Denne strategien fører til en posisjon.

Strategi 2:

Kjøpssignaler:

Salgsignaler:

Nøytrale signaler:

Resultat: Denne strategien fører til en posisjon.

Strategi 3:

Kjøpssignaler:

Salgsignaler:

Nøytrale signaler:

Resultat: Denne strategien fører til en posisjon.

Strategi 4:

Kjøpssignaler:

Salgsignaler:

Nøytrale signaler:

Resultat: Denne strategien fører til en posisjon.

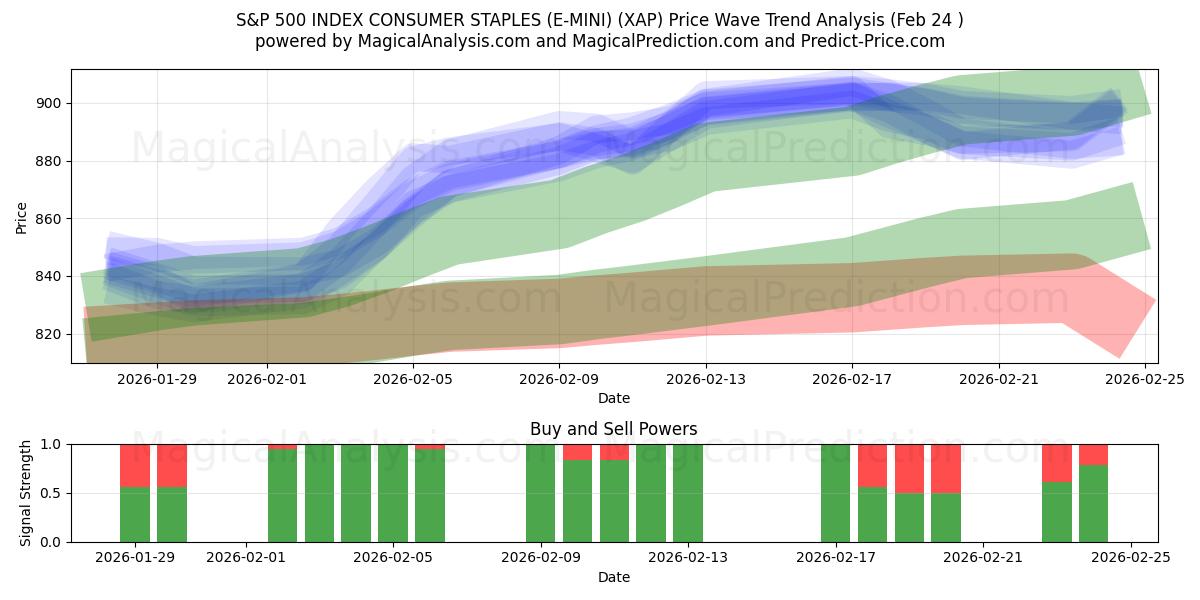

Overordnet strategi:

Kjøpssignaler: 22

Salgsignaler: 6

Nøytrale signaler: 71

Resultat: Denne strategien fører til en Kjøp posisjon.

Ansvarsfraskrivelse! Vennligst vær forsiktig og vurder grundig før du tar noen finansielle beslutninger. Det er viktig å merke seg at signalene våre er basert utelukkende på daglige prisendringer og ikke tar hensyn til eksterne faktorer som nyheter, markedssentiment eller selskapsutvikling. Vi anbefaler sterkt å vurdere alle relevante faktorer og gjennomføre din egen forskning.

Nyttige tips: For å ta de mest informerte beslutningene om investeringene dine i S&P 500 INDEX CONSUMER STAPLES (E-MINI) (XAP), anbefaler vi sterkt å besøke "magicalprediction" AI-modellens signalnettsted. De gir gratis signaler, og hvis en av dem samsvarer med våre, er det sannsynligvis en pålitelig indikator, som vi har observert over tid.

Resultat: Når vi ser på den tekniske analysen for S&P 500 INDEX CONSUMER STAPLES (E-MINI) (XAP) den , ser det ut til å være en tendens mot et kjøpssignal basert på historiske data og analyser. Det er imidlertid viktig å huske at disse signalene ikke er garantier, og enhver investeringsbeslutning bør tas nøye. Vurder de generelle markedsforholdene og hvordan valgene dine samsvarer med dine spesifikke investeringsmål.

Basert på de ovennevnte signalene, anbefaler vi følgende strategier:

S&P 500 INDEX CONSUMER STAPLES (E-MINI) (XAP) handelsstrategi for de som har kjøpsposisjoner (lange posisjoner): Hvis du for øyeblikket har en kjøpsposisjon (lang), kan det være en god strategi å holde posisjonen din ifølge våre signaler. Vær imidlertid alltid forsiktig og overvåk markedets utvikling nøye.

S&P 500 INDEX CONSUMER STAPLES (E-MINI) (XAP) handelsstrategi for de som har salgsposisjoner (korte posisjoner): Hvis du for øyeblikket har en salgsposisjon (kort), anbefales det å velge det optimale tidspunktet for å gå ut basert på vår kombinasjon av signaler. Hvis du har høyere risikotoleranse, vurder å vente på markedsbevegelser i de kommende dagene.

For nye posisjoner: Hvis du ikke er i markedet for øyeblikket eller vurderer å gå over til en kjøpsposisjon (lang), er det tilrådelig å vurdere det projiserte prisintervallet. Dette intervallet representerer en potensiell oppside på -100%, bestemt av den høyeste forutsagte prisen. Før du bestemmer deg for å gå inn i en kjøpsposisjon, vær forsiktig og gjennomfør grundig forskning for å sikre at det samsvarer med din risikotoleranse og investeringsmål.

I alle dine handelsforetak er det avgjørende å implementere en veldefinert stop-loss-strategi for effektivt å håndtere potensielle nedside-risikoer.

Nyttig tips 2: For de som er interessert i langsiktig prognostisering, foreslår vi å bruke "predict-price" nettstedet, som tilbyr både kortsiktige og langsiktige spådommer gratis. Dette kan hjelpe deg med å ta mer informerte beslutninger angående dine **S&P 500 INDEX CONSUMER STAPLES (E-MINI) (XAP)** investeringer.

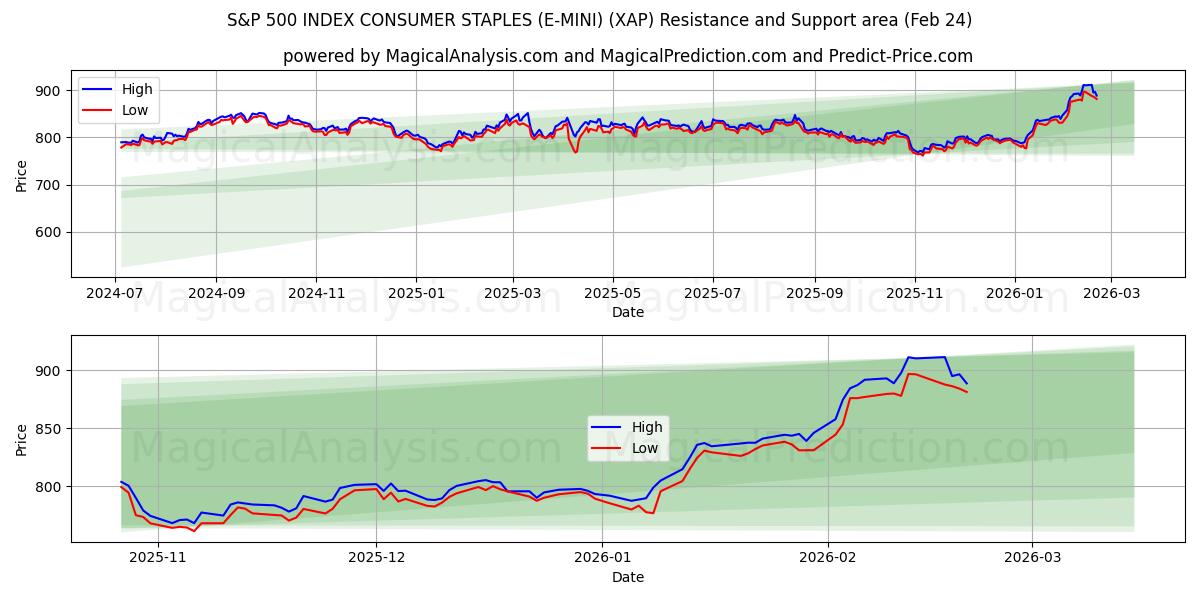

S&P 500 INDEX CONSUMER STAPLES (E-MINI) (XAP) Pris Analyse og Motstands nivåer:

Gitt vår nåværende lange posisjon i S&P 500 INDEX CONSUMER STAPLES (E-MINI) (XAP), er det avgjørende å analysere nøkkelnivåer for motstand for bedre å forstå prisbevegelsen. Disse nivåene er viktige referansepunkter for strategien vår, og vi vil utforske flere scenarier for å gi en omfattende oversikt.Første motstandsnivå (0): Det primære hinderet vi står overfor er prisen 0. Hvis den nåværende trenden forblir uendret, kan S&P 500 INDEX CONSUMER STAPLES (E-MINI) (XAP) bryte over dette nivået, noe som signaliserer styrken og potensialet for videre vekst.

Det er essensielt å overvåke disse motstandsnivåene nøye og vurdere dem i den bredere konteksten av markedsbevegelser og indikatorer. For å ta informerte beslutninger når du handler S&P 500 INDEX CONSUMER STAPLES (E-MINI) (XAP), vær på vakt og analyser kontinuerlig markedet. Ved å fokusere på disse motstandsnivåene og vurdere bredere markedsdynamikk, kan du ta smartere handelsbeslutninger og tilpasse deg dette dynamiske markedet.

S&P 500 INDEX CONSUMER STAPLES (E-MINI) (XAP) teknisk analyse diagram

S&P 500 INDEX CONSUMER STAPLES (E-MINI) (XAP) støtte og motstandsnivåer

| Navn | Level1 | Level2 | Level3 | Level4 | Level5 |

|---|---|---|---|---|---|

| Motstand | -- | -- | -- | -- | -- |

| Støtte | 847.4 | 770.7 | 761.4 | -- | -- |

S&P 500 INDEX CONSUMER STAPLES (E-MINI) (XAP) signaler liste for 23 Feb

| Overall Signals |

|---|

S&P 500 INDEX CONSUMER STAPLES (E-MINI) (XAP) candlestick mønstre på 23 Feb

S&P 500 INDEX CONSUMER STAPLES (E-MINI) (XAP) teknisk analyse de siste dagene

| # | Date | Overal Signals | ALL Signals |

|---|---|---|---|

| 1 | 23 Feb | B | DEMA 2DEMA 3TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 3PLUS_DI Threshold 1PLUS_DI Threshold 2ROCR Threshold 1BOP Smoothed ThresholdADXR with DI+/DI- |

| 2 | 20 Feb | N | DEMA 1DEMA 2DEMA 3EMA Crossover 1WMA Crossover 2MIDPOINT Slope 1TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3PLUS_DI Threshold 1PLUS_DI Threshold 2TRIX Crossover 1BOP Smoothed ThresholdMACD Crossover 2Engulfing PatternADXR with DI+/DI-CMO Divergence 1 |

| 3 | 19 Feb | S | DEMA 1DEMA 2WMA Crossover 1TEMA Price 2TEMA Price 3TRIMA Slope 2TRIMA Slope 3SAR CrossoverPLUS_DI Threshold 1PLUS_DI Threshold 2OBV CrossoverChaikin ADOSC Zero CrossVolume SpikeADXR with DI+/DI-CMO Divergence 1 |

| 4 | 18 Feb | S | DEMA 1DEMA 2EMA Price Cross 4KAMA 4MIDPOINT Slope 3TEMA Price 1TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3CCI Crossover 1CCI Crossover 2PLUS_DI Threshold 1PLUS_DI Threshold 2RSI Exit OversoldRSI Exit OverboughtBOP Smoothed ThresholdMACD Crossover 1STOCH Normal Zone CrossStochastic RSI SignalChaikin AD CrossoverEngulfing PatternVolume SpikeADXR with DI+/DI-Daily Pivot Point 1Elder's Force IndexCMO Divergence 1 |

| 5 | 17 Feb | S | DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 3TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdSTOCH Normal Zone CrossADXR with DI+/DI-CMO Divergence 1 |

| 6 | 13 Feb | B | DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 3TRIMA Slope 2TRIMA Slope 3PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdDEMA with ATR 3ADXR with DI+/DI-Donchian ChannelDaily Pivot Point 1CMO Divergence 1 |

| 7 | 12 Feb | B | DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4TRIMA Slope 2TRIMA Slope 3CMO Crossover 1CMO Crossover 2PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdStochastic RSI SignalOBV CrossoverEngulfing PatternDEMA with ATR 3Volume SpikeADXR with DI+/DI-Donchian ChannelDaily Pivot Point 1CMO Divergence 1 |

| 8 | 11 Feb | B | DEMA 1KAMA 2KAMA 3KAMA 4TEMA Price 2TEMA Price 3TRIMA Slope 2TRIMA Slope 3CCI Crossover 1PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdUltimate OscillatorOBV CrossoverChaikin AD CrossoverVolume SpikeADXR with DI+/DI-CMO Divergence 1 |

| 9 | 10 Feb | N | KAMA 1KAMA 2KAMA 3KAMA 4T3 Slope 1T3 Slope 2TRIMA Slope 1TRIMA Slope 2CCI Crossover 3PLUS_DI Threshold 1PLUS_DI Threshold 2BBANDS Breakout 2Stochastic RSI SignalMoney Flow IndexADXR with DI+/DI-CMO Divergence 1 |

| 10 | 09 Feb | B | DEMA 2DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 1MIDPOINT Slope 2MIDPOINT Slope 4T3 Slope 1T3 Slope 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdSTOCH Normal Zone CrossEngulfing PatternADXR with DI+/DI-Donchian ChannelDaily Pivot Point 1CMO Divergence 1 |

| 11 | 06 Feb | B | DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 2MIDPOINT Slope 4T3 Slope 1TEMA Price 3TRIMA Slope 1TRIMA Slope 2PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdBBANDS Breakout 2Ultimate OscillatorADXR with DI+/DI- |

| 12 | 05 Feb | B | DEMA 1DEMA 2DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 1MIDPOINT Slope 2MIDPOINT Slope 4T3 Slope 1TEMA Price 2TEMA Price 3TRIMA Slope 1PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdDEMA with ATR 2DEMA with ATR 3Volume SpikeADXR with DI+/DI-Donchian ChannelDaily Pivot Point 1CMO Divergence 1 |

| 13 | 04 Feb | B | DEMA 1DEMA 2DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 1MIDPOINT Slope 2MIDPOINT Slope 3MIDPOINT Slope 4T3 Slope 1TEMA Price 1TEMA Price 2TEMA Price 3TRIMA Slope 1AROONOSC 3CMO Crossover 2PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdDonchian ChannelDaily Pivot Point 1CMO Divergence 1 |

| 14 | 03 Feb | B | DEMA 1DEMA 2DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 1MIDPOINT Slope 2MIDPOINT Slope 4T3 Slope 1TEMA Price 1TEMA Price 2TEMA Price 3TRIMA Slope 1CMO Crossover 1PLUS_DI Threshold 1PLUS_DI Threshold 2ROC Threshold 1ROCR Threshold 1BOP Smoothed ThresholdMACD Crossover 1STOCH Normal Zone CrossDonchian ChannelDaily Pivot Point 1CMO Divergence 1 |

| 15 | 02 Feb | B | DEMA 1EMA Price Cross 1EMA Price Cross 4KAMA 1KAMA 2KAMA 3KAMA 4EMA Crossover 1WMA Crossover 1WMA Crossover 2MIDPOINT Slope 1MIDPOINT Slope 4TEMA Price 1TEMA Price 2TRIMA Slope 1TRIMA Slope 3MOM Crossover 1PLUS_DI Threshold 1PLUS_DI Threshold 2ROCR Threshold 2WILLR Exit OversoldWILLR Exit OverboughtBOP Smoothed ThresholdStochastic RSI SignalKeltner Channel 1Donchian ChannelDaily Pivot Point 1CMO Divergence 1 |

| 16 | 30 Jan | B | DEMA 1DEMA 2EMA Price Cross 1KAMA 3KAMA 4EMA Crossover 1WMA Crossover 2TEMA Price 2TEMA Price 3TRIMA Slope 3MOM Crossover 1PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdMoney Flow IndexChaikin AD CrossoverCMO Divergence 1 |

| 17 | 29 Jan | S | DEMA 1DEMA 2EMA Price Cross 4KAMA 3KAMA 4WMA Crossover 1MIDPOINT Slope 1TEMA Price 1TEMA Price 2TEMA Price 3TRIMA Slope 2TRIMA Slope 3PLUS_DI Threshold 1PLUS_DI Threshold 2RSI Exit OversoldRSI Exit OverboughtBOP Smoothed ThresholdStochastic RSI SignalUltimate OscillatorDaily Pivot Point 1CMO Divergence 1 |

| 18 | 28 Jan | S | KAMA 1KAMA 3KAMA 4MIDPOINT Slope 3TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdEngulfing PatternCMO Divergence 1 |

| 19 | 27 Jan | B | KAMA 1KAMA 3KAMA 4EMA Crossover 5MIDPOINT Slope 3TEMA Price 2TEMA Price 3TRIMA Slope 2TRIMA Slope 3CCI Crossover 2PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdStochastic RSI SignalGolden/Death Cross (EMA50/EMA200) |

| 20 | 26 Jan | B | DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 3TRIMA Slope 2TRIMA Slope 3CMO Crossover 1PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdMACD Crossover 1STOCH Normal Zone CrossStochastic RSI SignalDEMA with ATR 3Donchian ChannelDaily Pivot Point 1CMO Divergence 1 |

| 21 | 23 Jan | B | KAMA 1KAMA 3KAMA 4WMA Crossover 5MIDPOINT Slope 3TEMA Price 2TRIMA Slope 2TRIMA Slope 3PLUS_DI Threshold 1PLUS_DI Threshold 2Engulfing PatternIchimoku 1CMO Divergence 1 |

| 22 | 22 Jan | B | KAMA 1KAMA 2KAMA 3KAMA 4T3 Slope 2TRIMA Slope 2TRIMA Slope 3AROONOSC 4PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdCMO Divergence 1 |

| 23 | 21 Jan | B | DEMA 3KAMA 2KAMA 3KAMA 4T3 Slope 2TRIMA Slope 2TRIMA Slope 3CCI Crossover 1PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdDEMA with ATR 3Volume SpikeDaily Pivot Point 1 |

| 24 | 20 Jan | B | DEMA 3KAMA 2KAMA 3KAMA 4T3 Slope 1T3 Slope 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2CCI Crossover 3PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdBBANDS Breakout 2Stochastic RSI Signal |

| 25 | 16 Jan | B | DEMA 2DEMA 3KAMA 2KAMA 3KAMA 4T3 Slope 1T3 Slope 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2AROONOSC 2PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdDEMA with ATR 2DEMA with ATR 3Donchian ChannelCMO Divergence 1 |

| 26 | 15 Jan | B | DEMA 1DEMA 2DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 1MIDPOINT Slope 2MIDPOINT Slope 3MIDPOINT Slope 4T3 Slope 1T3 Slope 2TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2AROONOSC 3PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdDEMA with ATR 2DEMA with ATR 3Volume SpikeDonchian ChannelCMO Divergence 1 |

| 27 | 14 Jan | B | DEMA 1DEMA 2DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 1MIDPOINT Slope 2MIDPOINT Slope 3MIDPOINT Slope 4T3 Slope 1T3 Slope 2TEMA Price 2TEMA Price 3TRIMA Slope 1AROONOSC 1CMO Crossover 1PLUS_DI Threshold 1PLUS_DI Threshold 2TRIX Crossover 2BOP Smoothed ThresholdDonchian ChannelDaily Pivot Point 1CMO Divergence 1Coppock Curve |

| 28 | 13 Jan | B | DEMA 1DEMA 2DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4EMA Crossover 4WMA Crossover 3MIDPOINT Slope 1MIDPOINT Slope 2MIDPOINT Slope 3MIDPOINT Slope 4T3 Slope 1TEMA Price 2TEMA Price 3TRIMA Slope 1PLUS_DI Threshold 1PLUS_DI Threshold 2ROC Threshold 1ROC Threshold 2ROCR Threshold 3TRIX Crossover 1BOP Smoothed ThresholdPercentage Price OscillatorOBV CrossoverDEMA with ATR 1DEMA with ATR 2DEMA with ATR 3Keltner Channel 1Donchian ChannelCMO Divergence 1CMO Divergence 2 |

| 29 | 12 Jan | B | DEMA 1DEMA 2DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4EMA Crossover 2EMA Crossover 3WMA Crossover 2MIDPOINT Slope 1MIDPOINT Slope 2MIDPOINT Slope 3MIDPOINT Slope 4T3 Slope 1TEMA Price 1TEMA Price 2TEMA Price 3TRIMA Slope 1MOM Crossover 2PLUS_DI Threshold 1PLUS_DI Threshold 2ROCR Threshold 1WILLR Exit OverboughtBOP Smoothed ThresholdMACD Crossover 2Chaikin ADOSC Zero CrossRolling VWAPVortex IndicatorCMO Divergence 1 |

| 30 | 09 Jan | B | DEMA 1DEMA 2DEMA 3EMA Price Cross 1EMA Price Cross 2EMA Price Cross 3EMA Price Cross 4KAMA 1KAMA 2EMA Crossover 1WMA Crossover 1MIDPOINT Slope 1MIDPOINT Slope 2T3 Slope 2TEMA Price 1TEMA Price 2TEMA Price 3SAR CrossoverCCI Crossover 1CCI Crossover 2CCI Crossover 3MOM Crossover 1ROCR Threshold 2ROCR Threshold 4RSI Exit OversoldWILLR Exit OversoldBOP Smoothed ThresholdMACD Crossover 1STOCH Normal Zone CrossBBANDS Breakout 1BBANDS Breakout 2Stochastic RSI SignalMoney Flow IndexChaikin AD CrossoverEngulfing PatternIchimoku 2Ichimoku 3Daily Pivot Point 1Elder's Force IndexCMO Divergence 1 |

Brukerforutsigelser for S&P 500 INDEX CONSUMER STAPLES (E-MINI) (XAP)

Hva er din prediksjon?

In this section, you can easily predict without user registration. See also other users predictions.