Free Trading Signals by Technical Analysis

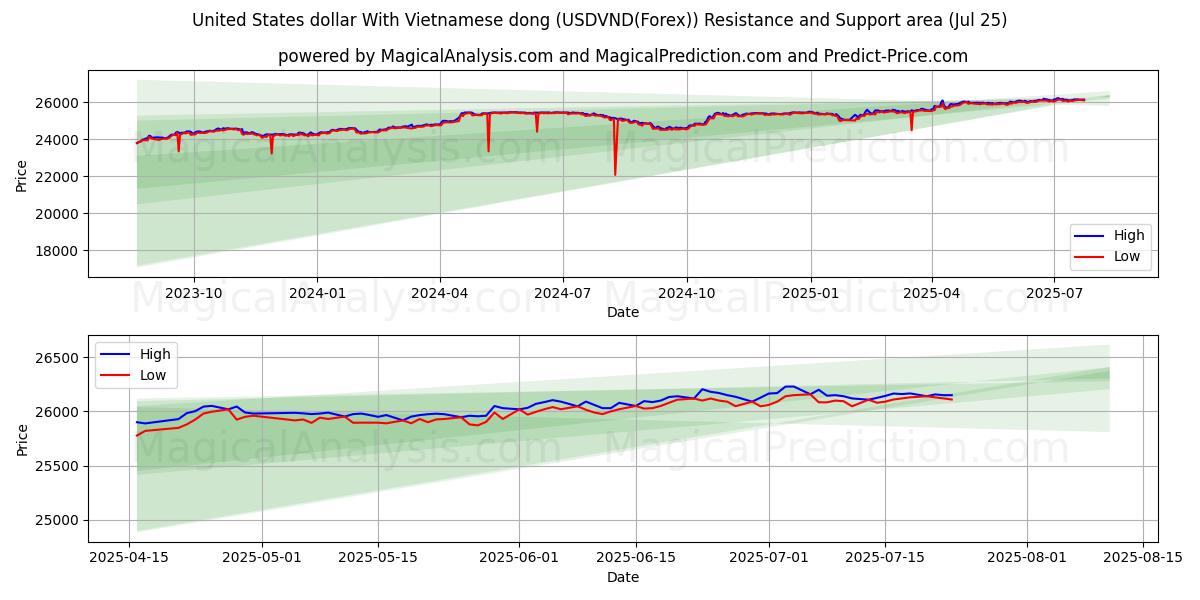

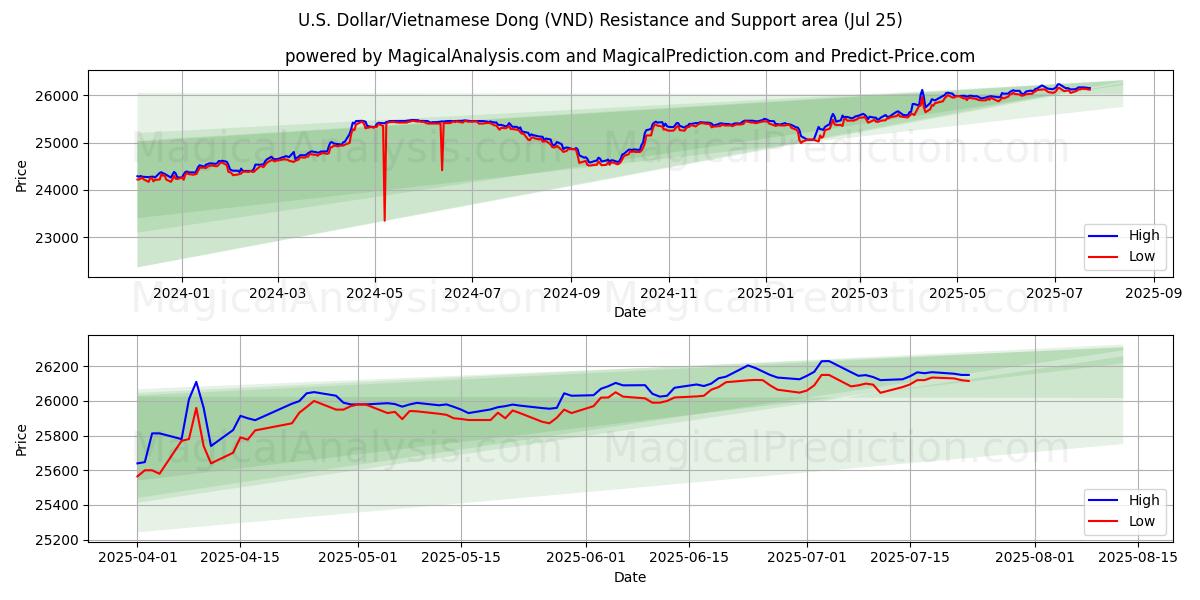

United States dollar With Vietnamese dong (USDVND(Forex)) Sell Signal for 23 Jul Based on Technical Analysis

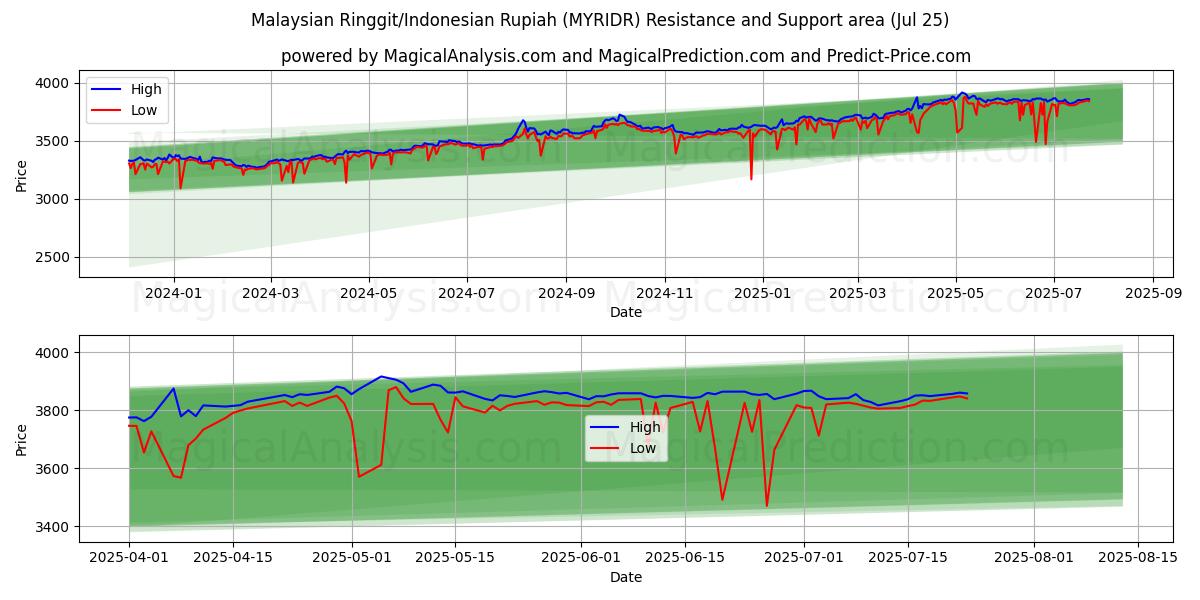

Malaysian Ringgit/Indonesian Rupiah (MYRIDR) Buy Signal for 24 Jul Based on Technical Analysis

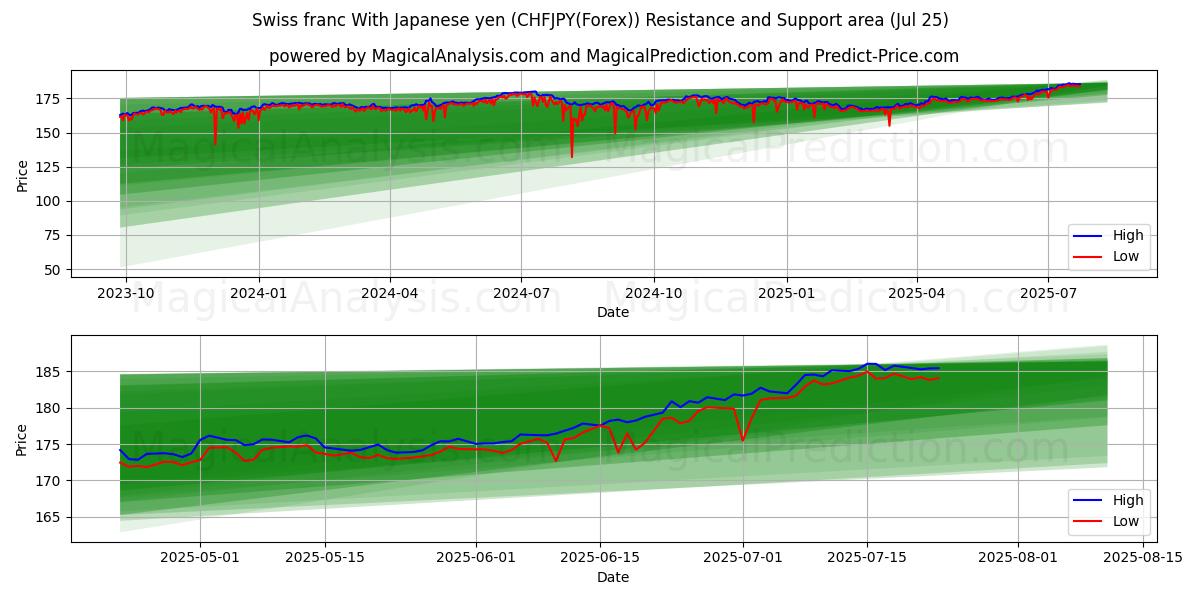

Swiss franc With Japanese yen (CHFJPY(Forex)) Sell Signal for 23 Jul Based on Technical Analysis

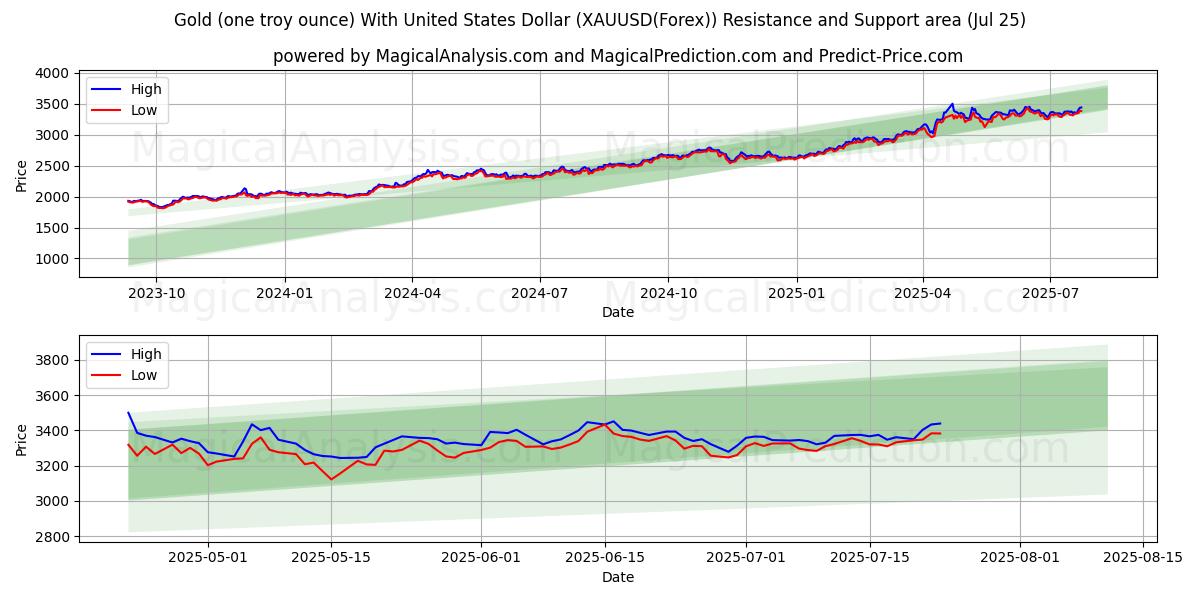

Gold (one troy ounce) With United States Dollar (XAUUSD(Forex)) Neutral Signal for 23 Jul Based on Technical Analysis

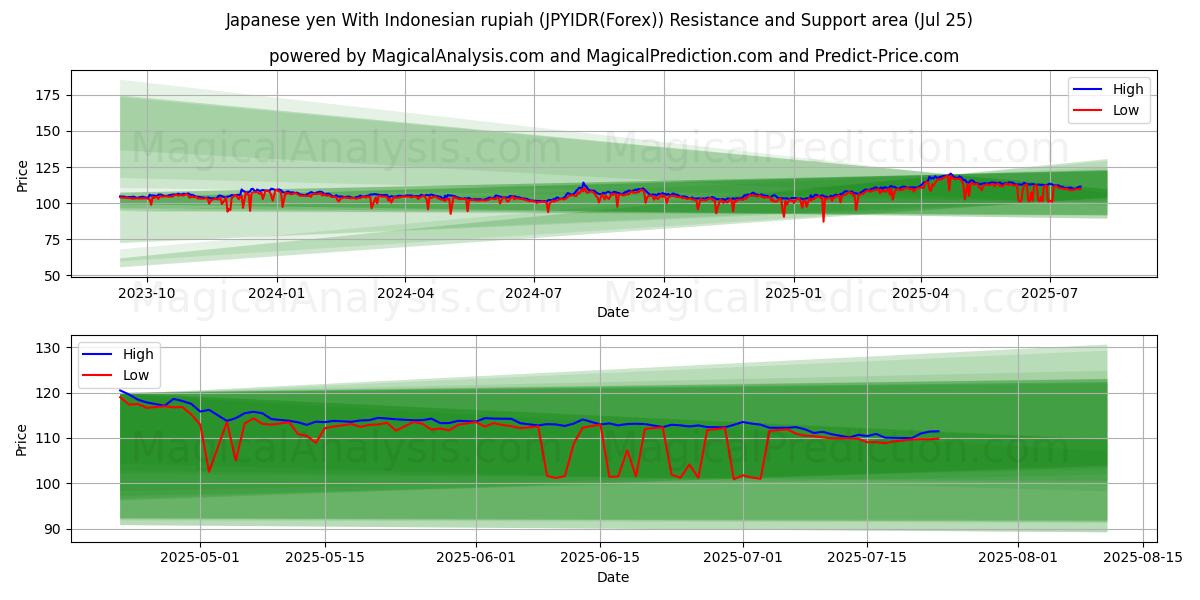

Japanese yen With Indonesian rupiah (JPYIDR(Forex)) Neutral Signal for 24 Jul Based on Technical Analysis

Wilshire exUS Real Estate Secur (WXRESI) Sell Signal for 03 Jan Based on Technical Analysis

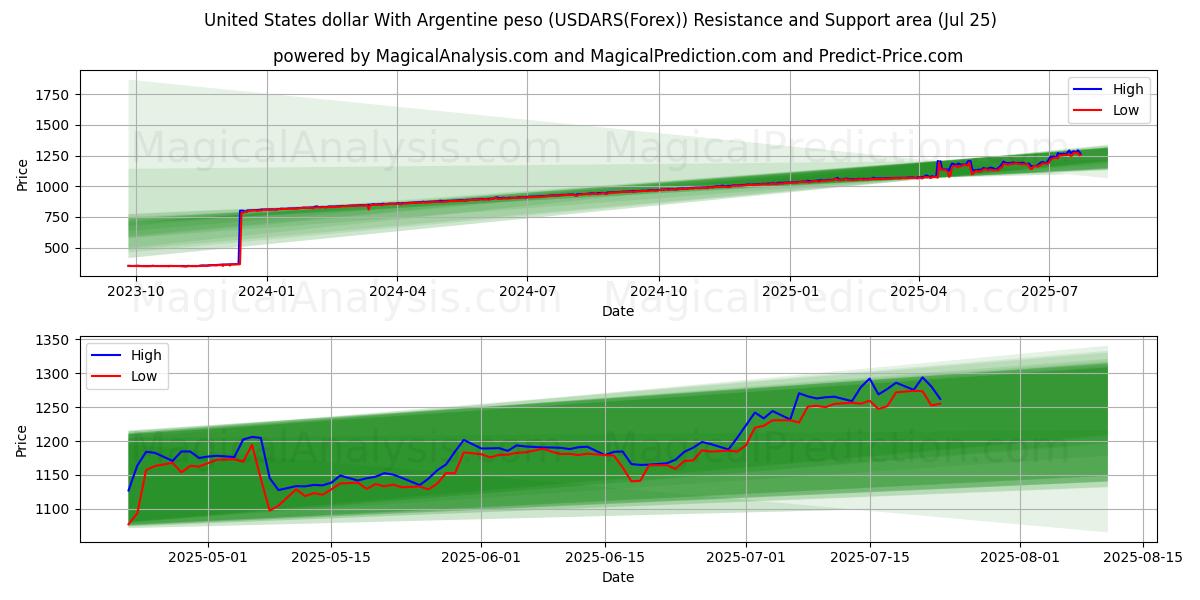

United States dollar With Argentine peso (USDARS(Forex)) Sell Signal for 23 Jul Based on Technical Analysis