Gratis Euro med indisk rupee (EURINR(Forex)) Teknisk Analyse Signaler

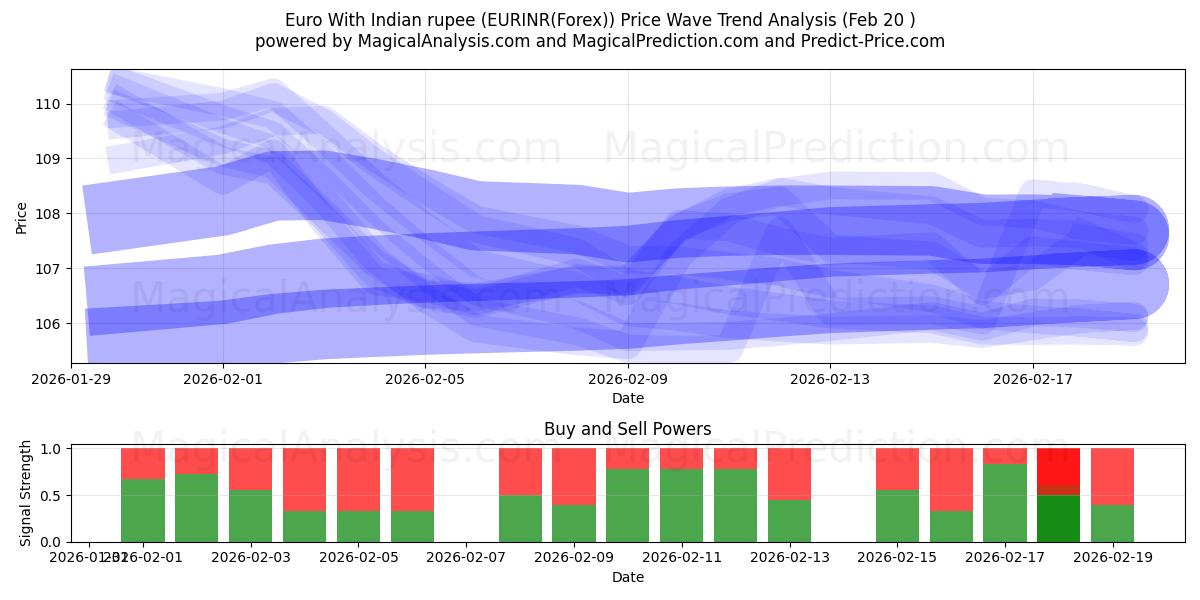

Euro med indisk rupee (EURINR(Forex)) signal med teknisk analyse på 19 Feb

De 256 signaler blev kategoriseret i fire forskellige strategier, hver bestående af 64 signaler. Lad os dykke ned i detaljerne for hver strategi:

Strategi 1:

Købssignaler:

Salgssignaler:

Neutrale signaler:

Resultat: Denne strategi fører til en position.

Strategi 2:

Købssignaler:

Salgssignaler:

Neutrale signaler:

Resultat: Denne strategi fører til en position.

Strategi 3:

Købssignaler:

Salgssignaler:

Neutrale signaler:

Resultat: Denne strategi fører til en position.

Strategi 4:

Købssignaler:

Salgssignaler:

Neutrale signaler:

Resultat: Denne strategi fører til en position.

Overordnet strategi:

Købssignaler: 4

Salgssignaler: 5

Neutrale signaler: 90

Resultat: Denne strategi fører til en Neutral position.

Ansvarsfraskrivelse! Vær venlig at udvise forsigtighed og grundig overvejelse, inden du træffer nogen finansielle beslutninger. Det er vigtigt at bemærke, at vores signaler udelukkende er baseret på daglige prisændringer og ikke tager højde for eksterne faktorer såsom nyheder, markedssentiment eller virksomhedens udvikling. Vi anbefaler kraftigt at overveje alle relevante faktorer og foretage din egen forskning.

Nyttige tips: For at træffe de mest informerede beslutninger om dine Euro med indisk rupee (EURINR(Forex)) investeringer, anbefaler vi kraftigt at besøge "magicalprediction" AI-modeller signalwebstedet. De tilbyder gratis signaler, og hvis et signal stemmer overens med vores, er det sandsynligvis en pålidelig indikator, som vi har observeret over tid.

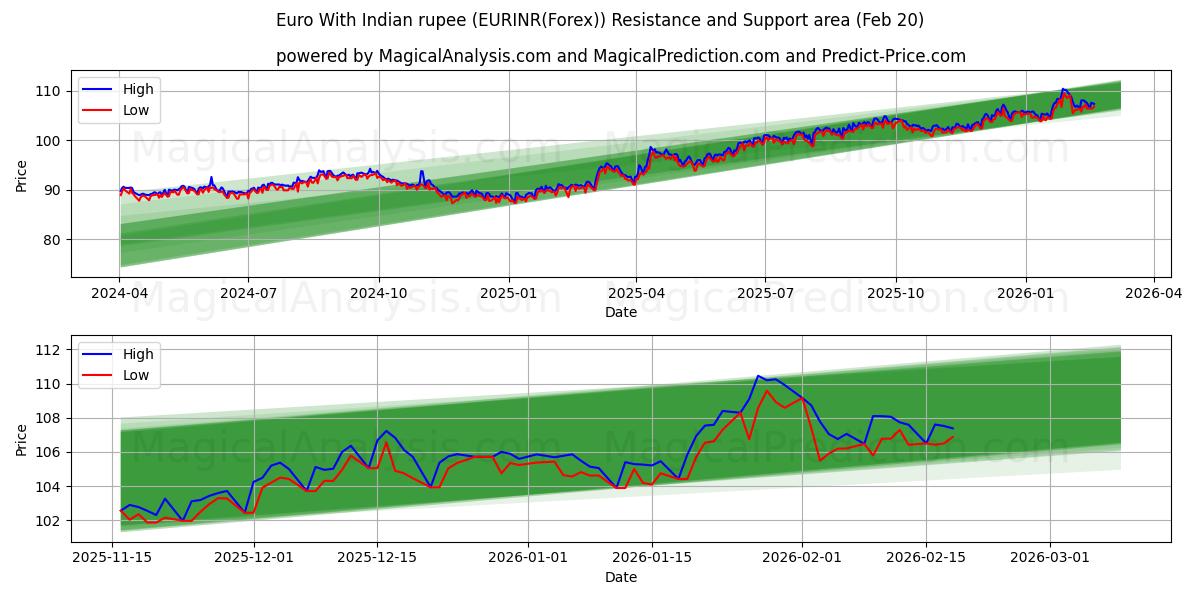

Andet støtteniveau: 100.899

Hvis det første støtteniveau brydes, bliver det andet støtteniveau ved 100.899 en kritisk punkt. Brud på dette niveau ville indikere stærkere nedadgående momentum, sandsynligvis drevet af markedssentiment eller eksterne faktorer.

Tredje støtteniveau: 87.256

Hvis det andet støtteniveau brydes, og prisen fortsætter med at falde, signalerer det et betydeligt markedsskift. Forbliver prisen under 87.256, ville det bekræfte en vedvarende nedadgående trend, hvor tradere sandsynligvis målretter mod dette tredje niveau som det næste nøglestøttepunkt.

Disse støtteniveauer bør overvejes omhyggeligt i konteksten af bredere markedstendenser og indikatorer. At være opmærksom og konsekvent analysere markedet vil gøre det muligt for dig at træffe informerede beslutninger, mens du handler Euro med indisk rupee (EURINR(Forex)). At være opmærksom på disse støtteniveauer vil hjælpe dig med at tilpasse dig den dynamiske natur af markedet og træffe smartere handelsbeslutninger. Det er vigtigt nøje at overvåge disse modstandsniveauer og overveje dem i konteksten af bredere markedstendenser og indikatorer. For at træffe informerede beslutninger, når du handler Euro med indisk rupee (EURINR(Forex)), skal du forblive vågen og kontinuerligt analysere markedet. At fokusere på disse modstandsniveauer sammen med bredere markedsdynamik vil hjælpe dig med at træffe smartere handelsbeslutninger og tilpasse dig de skiftende markedsforhold.

Euro med indisk rupee (EURINR(Forex)) teknisk analyse diagram

Euro med indisk rupee (EURINR(Forex)) støtte- og modstandsniveauer

| Navn | Level1 | Level2 | Level3 | Level4 | Level5 |

|---|---|---|---|---|---|

| Modstand | -- | -- | -- | -- | -- |

| Understøttelse | 103.889 | 100.899 | 87.256 | -- | -- |

Euro med indisk rupee (EURINR(Forex)) signalliste for 19 Feb

| Overall Signals |

|---|

Euro med indisk rupee (EURINR(Forex)) lysestage mønstre på 19 Feb

Euro med indisk rupee (EURINR(Forex)) teknisk analyse i de seneste dage

| # | Date | Overal Signals | ALL Signals |

|---|

Brugerforudsigelser for Euro med indisk rupee (EURINR(Forex))

Hvad er din forudsigelse?

In this section, you can easily predict without user registration. See also other users predictions.