Gratis Sunstone Hotel Investors Inc. (SHO) Teknisk Analyse Signaler

Sunstone Hotel Investors Inc. (SHO) signal med teknisk analyse på 19 Feb

De 256 signaler blev kategoriseret i fire forskellige strategier, hver bestående af 64 signaler. Lad os dykke ned i detaljerne for hver strategi:

Strategi 1:

Købssignaler:

Salgsignaler:

Neutrale signaler:

Resultat: Denne strategi fører til en position.

Strategi 2:

Købssignaler:

Salgsignaler:

Neutrale signaler:

Resultat: Denne strategi fører til en position.

Strategi 3:

Købssignaler:

Salgsignaler:

Neutrale signaler:

Resultat: Denne strategi fører til en position.

Strategi 4:

Købssignaler:

Salgsignaler:

Neutrale signaler:

Resultat: Denne strategi fører til en position.

Overordnet strategi:

Købssignaler: 13

Salgsignaler: 2

Neutrale signaler: 84

Resultat: Denne strategi fører til en Køb position.

Advarsel! Venligst udvis forsigtighed og grundig overvejelse, inden du træffer nogen økonomiske beslutninger. Det er vigtigt at bemærke, at vores signaler udelukkende er baseret på daglige prisændringer og ikke tager hensyn til eksterne faktorer som nyheder, markedsstemning eller virksomhedens udvikling. Vi anbefaler stærkt at overveje alle relevante faktorer og udføre din egen research.

Nyttige tips: For at træffe de mest informerede beslutninger om dine Sunstone Hotel Investors Inc. (SHO) investeringer anbefaler vi kraftigt at besøge "magicalprediction" AI-modeller signalwebsted. De tilbyder gratis signaler, og hvis en af dem stemmer overens med vores, er det sandsynligvis en pålidelig indikator, som vi har observeret over tid.

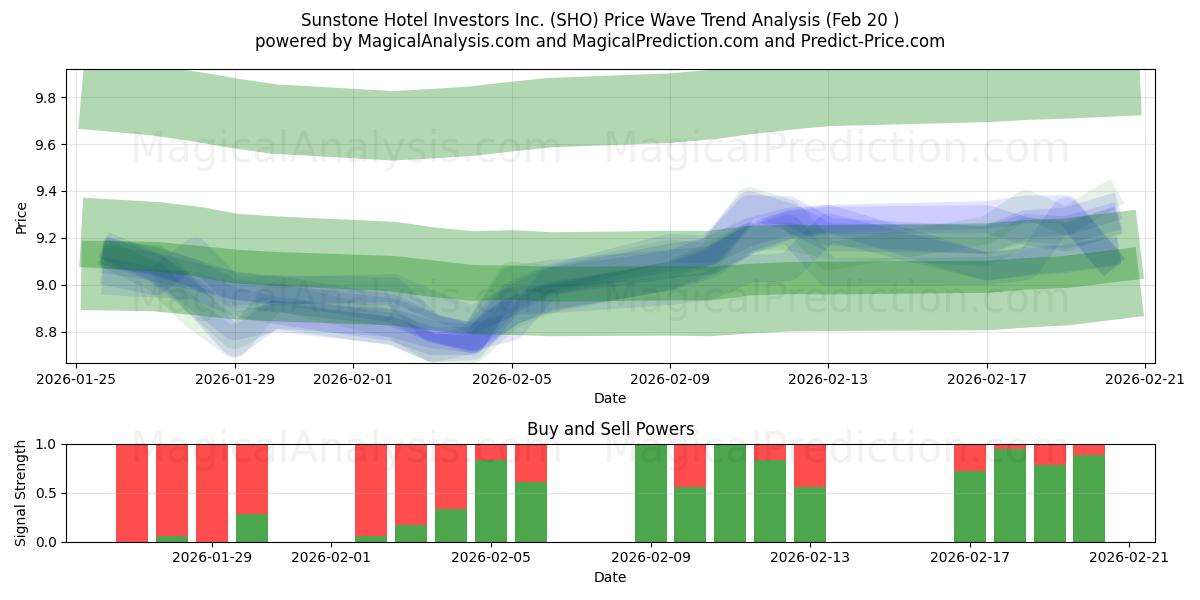

Resultat: Når vi ser på den tekniske analyse for Sunstone Hotel Investors Inc. (SHO) den , synes der at være en tendens mod et købesignal baseret på historiske data og analyser. Det er dog vigtigt at huske, at disse signaler ikke er garantier, og at enhver investeringsbeslutning skal træffes omhyggeligt. Overvej de generelle markedsforhold, og hvordan dine valg stemmer overens med dine specifikke investeringsmål.

Baseret på ovenstående signaler anbefaler vi følgende strategier:

Sunstone Hotel Investors Inc. (SHO) handelsstrategi for dem i købpositioner (lange positioner): Hvis du i øjeblikket er i en køb (lang) position, kan det være en god strategi at holde din position ifølge vores signaler. Men udvis altid forsigtighed og overvåg markedsudviklingen tæt.

Sunstone Hotel Investors Inc. (SHO) handelsstrategi for dem i salgspositioner (korte positioner): Hvis du i øjeblikket er i en salg (kort) position, anbefales det at vælge det optimale tidspunkt at exit baseret på vores signalkombination. Hvis du har en højere risikotolerance, kan du overveje at vente på markedsbevægelser i de kommende dage.

For nye positioner: Hvis du ikke i øjeblikket er på markedet eller overvejer at skifte til en køb (lang) position, er det tilrådeligt at overveje det projicerede prisinterval. Dette interval repræsenterer et potentielt opsving på 9.56%, bestemt af den højeste forudsete pris. Men før du beslutter at gå ind i en købposition, vær forsigtig og udfør grundig research for at sikre, at det stemmer overens med din risikotolerance og investeringsmål.

I alle dine handelsbestrebelser er det vigtigt at implementere en veldefineret stop-loss strategi for effektivt at håndtere potentielle nedadgående risici.

Nyttigt tip 2: For dem der er interesseret i langsigtede forudsigelser, anbefaler vi at bruge "predict-price" webstedet, som tilbyder både kortsigtede og langsigtede forudsigelser gratis. Dette kan hjælpe dig med at træffe mere informerede beslutninger om dine **Sunstone Hotel Investors Inc. (SHO)** beholdninger.

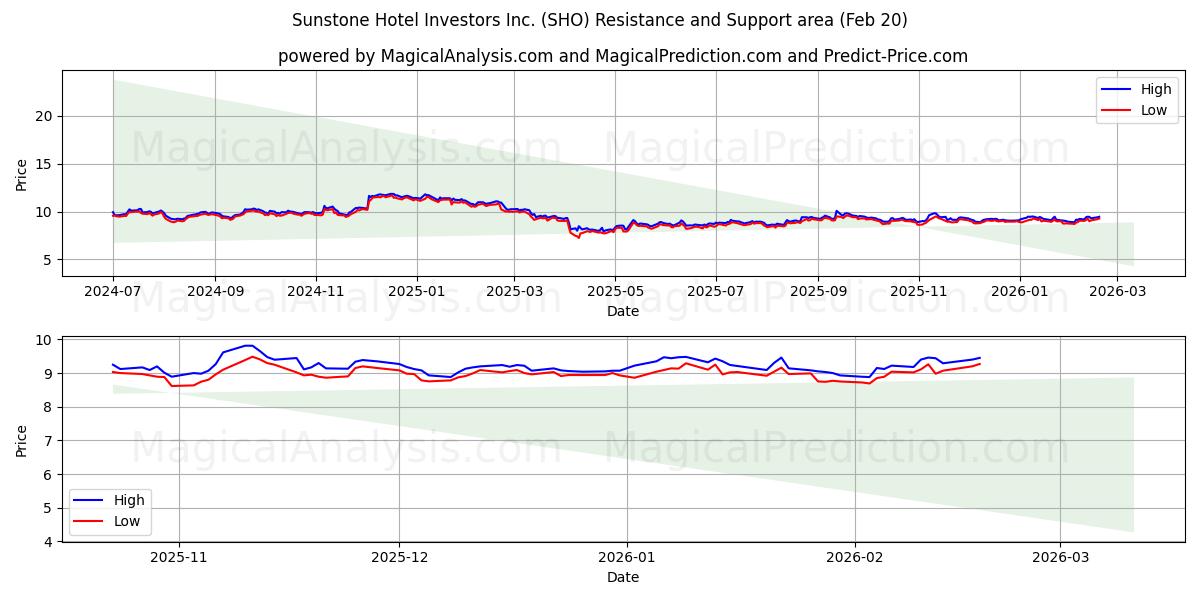

Sunstone Hotel Investors Inc. (SHO) prisanalyse og modstandsniveauer:

Givet vores nuværende lange position i Sunstone Hotel Investors Inc. (SHO), er det afgørende at analysere nøglemodstandsniveauer for bedre at forstå prisbevægelserne. Disse niveauer er vigtige benchmarks for vores strategi, og vi vil udforske flere scenarier for at give et omfattende perspektiv.Første modstandsniveau (10.073): Den primære hindring, vi står overfor, er prisniveauet 10.073. Hvis den nuværende trend forbliver uændret, kan Sunstone Hotel Investors Inc. (SHO) bryde over dette niveau, hvilket signalerer styrken og potentialet for yderligere vækst.

Andet modstandsniveau (10.276): Hvis den opadgående trend fortsætter med betydelig styrke, kan vi se Sunstone Hotel Investors Inc. (SHO) krydse det andet modstandsniveau ved 10.276, hvilket indikerer en stor opadgående bevægelse og en lovende retning for vores position.

Det er vigtigt at overvåge disse modstandsniveauer tæt og overveje dem i den bredere kontekst af markedstrends og indikatorer. For at træffe informerede beslutninger, når du handler med Sunstone Hotel Investors Inc. (SHO), vær opmærksom og analyser kontinuerligt markedet. Ved at fokusere på disse modstandsniveauer og overveje de bredere markedsdynamikker kan du træffe klogere handelsbeslutninger og tilpasse dig dette dynamiske marked.

Sunstone Hotel Investors Inc. (SHO) teknisk analyse diagram

Sunstone Hotel Investors Inc. (SHO) støtte- og modstandsniveauer

| Navn | Level1 | Level2 | Level3 | Level4 | Level5 |

|---|---|---|---|---|---|

| Modstand | 10.073 | 10.276 | -- | -- | -- |

| Understøttelse | 9.121 | 8.753 | 8.614 | 7.233 | -- |

Sunstone Hotel Investors Inc. (SHO) signalliste for 19 Feb

| Overall Signals |

|---|

Sunstone Hotel Investors Inc. (SHO) lysestage mønstre på 19 Feb

Sunstone Hotel Investors Inc. (SHO) teknisk analyse i de seneste dage

| # | Date | Overal Signals | ALL Signals |

|---|---|---|---|

| 1 | 19 Feb | B | DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 3T3 Slope 2TEMA Price 2TRIMA Slope 2TRIMA Slope 3CCI Crossover 1ROCR Threshold 1BOP Smoothed ThresholdSTOCH Normal Zone CrossChaikin AD CrossoverChaikin ADOSC Zero Cross |

| 2 | 18 Feb | B | DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4WMA Crossover 1WMA Crossover 4T3 Slope 2TEMA Price 3TRIMA Slope 2TRIMA Slope 3ROCR Threshold 1ROCR Threshold 4WILLR Exit OversoldWILLR Exit OverboughtBOP Smoothed ThresholdChaikin ADOSC Zero CrossIchimoku 1Daily Pivot Point 1 |

| 3 | 17 Feb | B | EMA Price Cross 4EMA Crossover 4WMA Crossover 1T3 Slope 2TRIMA Slope 2TRIMA Slope 3PLUS_DI Threshold 1PLUS_DI Threshold 2ROC Threshold 2BOP Smoothed ThresholdStochastic RSI Signal |

| 4 | 13 Feb | B | DEMA 1EMA Price Cross 4T3 Slope 2TEMA Price 1TEMA Price 2TRIMA Slope 1TRIMA Slope 2CCI Crossover 1CCI Crossover 2CCI Crossover 3ROCR Threshold 4BOP Smoothed ThresholdSTOCH Normal Zone CrossPercentage Price OscillatorDaily Pivot Point 1CMO Divergence 1 |

| 5 | 12 Feb | S | DEMA 3KAMA 1KAMA 4T3 Slope 1TEMA Price 3TRIMA Slope 1TRIMA Slope 2AROONOSC 2RSI Exit OversoldBOP Smoothed ThresholdStochastic RSI SignalCMO Divergence 2Coppock CurveSchaff Trend Cycle |

| 6 | 11 Feb | B | DEMA 1DEMA 2DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4EMA Crossover 3WMA Crossover 3MIDPOINT Slope 1MIDPOINT Slope 2MIDPOINT Slope 3MIDPOINT Slope 4T3 Slope 1TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2AROONOSC 3ROC Threshold 1ROCR Threshold 2ROCR Threshold 4TRIX Crossover 2WILLR Exit OverboughtBOP Smoothed ThresholdChaikin AD CrossoverDaily Pivot Point 1CMO Divergence 1 |

| 7 | 10 Feb | B | MIDPOINT Slope 4T3 Slope 1TEMA Price 3TRIMA Slope 1PLUS_DI Threshold 1PLUS_DI Threshold 2ROCR Threshold 3TRIX Crossover 1BOP Smoothed Threshold |

| 8 | 09 Feb | N | DEMA 1DEMA 2DEMA 3KAMA 1EMA Crossover 2MIDPOINT Slope 1MIDPOINT Slope 2MIDPOINT Slope 3T3 Slope 1TEMA Price 2TEMA Price 3TRIMA Slope 1SAR CrossoverAROONOSC 1MOM Crossover 1MOM Crossover 2PLUS_DI Threshold 2ROCR Threshold 1ROCR Threshold 2WILLR Exit OversoldBOP Smoothed ThresholdMACD Crossover 2BBANDS Breakout 1Ichimoku 2Ichimoku 3Daily Pivot Point 1CMO Divergence 1 |

| 9 | 06 Feb | B | DEMA 2WMA Crossover 2MIDPOINT Slope 3TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 3MOM Crossover 2PLUS_DI Threshold 1PLUS_DI Threshold 2ROCR Threshold 3Volume Spike |

| 10 | 05 Feb | N | DEMA 1DEMA 2DEMA 3EMA Price Cross 1EMA Price Cross 2EMA Price Cross 3EMA Price Cross 4KAMA 1EMA Crossover 1WMA Crossover 1MIDPOINT Slope 1TEMA Price 1TEMA Price 2TEMA Price 3TRIMA Slope 2TRIMA Slope 3CCI Crossover 1CCI Crossover 2MOM Crossover 2PLUS_DI Threshold 1PLUS_DI Threshold 2ROCR Threshold 1BOP Smoothed ThresholdMACD Crossover 1STOCH Normal Zone CrossVolume SpikeDaily Pivot Point 1Rolling VWAPVortex IndicatorElder's Force IndexCMO Divergence 1 |

| 11 | 04 Feb | B | DEMA 3KAMA 2KAMA 3KAMA 4MIDPOINT Slope 1T3 Slope 2TEMA Price 2TRIMA Slope 2TRIMA Slope 3AROONOSC 4CCI Crossover 3PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed Threshold |

| 12 | 03 Feb | S | DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4T3 Slope 2TEMA Price 3TRIMA Slope 2TRIMA Slope 3PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdDEMA with ATR 3Donchian ChannelCMO Divergence 1 |

| 13 | 02 Feb | S | DEMA 3EMA Price Cross 4KAMA 1KAMA 2KAMA 3KAMA 4T3 Slope 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2PLUS_DI Threshold 1PLUS_DI Threshold 2ROC Threshold 1ROCR Threshold 2ROCR Threshold 4WILLR Exit OversoldWILLR Exit OverboughtBOP Smoothed ThresholdStochastic RSI SignalDEMA with ATR 3Volume SpikeDaily Pivot Point 1 |

| 14 | 30 Jan | S | DEMA 1EMA Price Cross 4KAMA 2KAMA 3MIDPOINT Slope 2T3 Slope 2TEMA Price 1TEMA Price 2TRIMA Slope 1TRIMA Slope 2CCI Crossover 1CCI Crossover 3PLUS_DI Threshold 1PLUS_DI Threshold 2RSI Exit OversoldBOP Smoothed ThresholdBBANDS Breakout 2Stochastic RSI SignalDaily Pivot Point 1 |

| 15 | 29 Jan | N | DEMA 2DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4WMA Crossover 4MIDPOINT Slope 1MIDPOINT Slope 2MIDPOINT Slope 3MIDPOINT Slope 4T3 Slope 1T3 Slope 2TEMA Price 2TEMA Price 3TRIMA Slope 1AROONOSC 3PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdCMO Divergence 1 |

| 16 | 28 Jan | S | DEMA 1DEMA 2DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4EMA Crossover 4MIDPOINT Slope 1MIDPOINT Slope 2MIDPOINT Slope 3MIDPOINT Slope 4T3 Slope 1T3 Slope 2TEMA Price 1TEMA Price 2TEMA Price 3TRIMA Slope 1SAR CrossoverAROONOSC 1AROONOSC 4PLUS_DI Threshold 1PLUS_DI Threshold 2ROCR Threshold 4WILLR Exit OversoldBOP Smoothed ThresholdChaikin ADOSC Zero CrossDEMA with ATR 3Volume SpikeDonchian ChannelIchimoku 1Daily Pivot Point 1CMO Divergence 1 |

| 17 | 27 Jan | S | DEMA 3KAMA 2KAMA 3WMA Crossover 1MIDPOINT Slope 3T3 Slope 2TEMA Price 3TRIMA Slope 2TRIMA Slope 3AROONOSC 2ROC Threshold 2ROCR Threshold 3WILLR Exit OverboughtBOP Smoothed ThresholdSTOCH Normal Zone CrossCoppock Curve |

| 18 | 26 Jan | S | DEMA 3EMA Price Cross 3EMA Price Cross 4KAMA 1EMA Crossover 1EMA Crossover 3TEMA Price 2TEMA Price 3MOM Crossover 2ROC Threshold 1ROCR Threshold 1ROCR Threshold 2BOP Smoothed ThresholdBBANDS Breakout 1Percentage Price OscillatorOBV CrossoverIchimoku 2Daily Pivot Point 1Vortex IndicatorElder's Force Index |

| 19 | 23 Jan | S | EMA Price Cross 1EMA Price Cross 2EMA Crossover 1TRIMA Slope 2SAR CrossoverROCR Threshold 1BOP Smoothed ThresholdStochastic RSI SignalChaikin AD CrossoverIchimoku 3Rolling VWAPCMO Divergence 2 |

| 20 | 22 Jan | S | DEMA 1EMA Price Cross 1EMA Price Cross 2EMA Price Cross 3EMA Price Cross 4KAMA 4WMA Crossover 1MIDPOINT Slope 2MIDPOINT Slope 3TEMA Price 1TEMA Price 2TEMA Price 3TRIMA Slope 2CCI Crossover 1MOM Crossover 2PLUS_DI Threshold 1PLUS_DI Threshold 2ROC Threshold 2ROCR Threshold 3ROCR Threshold 4TRIX Crossover 2BOP Smoothed ThresholdSTOCH Normal Zone CrossBBANDS Breakout 1Stochastic RSI SignalIchimoku 2Daily Pivot Point 1Rolling VWAPVortex IndicatorElder's Force IndexCMO Divergence 1 |

| 21 | 21 Jan | B | DEMA 2DEMA 3KAMA 1KAMA 2KAMA 3WMA Crossover 3MIDPOINT Slope 3T3 Slope 1TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2AROONOSC 3MOM Crossover 1MOM Crossover 2PLUS_DI Threshold 1PLUS_DI Threshold 2ROC Threshold 1ROCR Threshold 2WILLR Exit OversoldBOP Smoothed ThresholdElder's Force IndexCMO Divergence 1 |

| 22 | 20 Jan | S | MIDPOINT Slope 1TEMA Price 3TRIMA Slope 1PLUS_DI Threshold 1PLUS_DI Threshold 2TRIX Crossover 1BOP Smoothed ThresholdMACD Crossover 2BBANDS Breakout 1Ichimoku 2Rolling VWAP |

| 23 | 16 Jan | S | EMA Crossover 2MIDPOINT Slope 3TEMA Price 1TEMA Price 3TRIMA Slope 1PLUS_DI Threshold 1PLUS_DI Threshold 2ROC Threshold 1ROCR Threshold 2ROCR Threshold 3BOP Smoothed ThresholdBBANDS Breakout 1Stochastic RSI SignalIchimoku 2Rolling VWAPElder's Force Index |

| 24 | 15 Jan | B | DEMA 1DEMA 2DEMA 3EMA Price Cross 1EMA Price Cross 2EMA Price Cross 3EMA Price Cross 4KAMA 1EMA Crossover 1WMA Crossover 1WMA Crossover 2MIDPOINT Slope 1MIDPOINT Slope 2TEMA Price 1TEMA Price 2TEMA Price 3TRIMA Slope 3SAR CrossoverAROONOSC 1CCI Crossover 2PLUS_DI Threshold 1PLUS_DI Threshold 2ROCR Threshold 1ROCR Threshold 4BOP Smoothed ThresholdMACD Crossover 1STOCH Normal Zone CrossBBANDS Breakout 1Ichimoku 2Ichimoku 3Daily Pivot Point 1Rolling VWAPVortex IndicatorElder's Force IndexCMO Divergence 1 |

| 25 | 14 Jan | S | EMA Price Cross 4KAMA 1KAMA 2KAMA 3KAMA 4T3 Slope 2TRIMA Slope 2TRIMA Slope 3PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdStochastic RSI SignalDaily Pivot Point 1 |

| 26 | 13 Jan | B | DEMA 1EMA Price Cross 4KAMA 4T3 Slope 2TEMA Price 1TEMA Price 2TEMA Price 3TRIMA Slope 2CCI Crossover 1CCI Crossover 2CCI Crossover 3PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdSTOCH Normal Zone CrossBBANDS Breakout 2CMO Divergence 1 |

| 27 | 12 Jan | S | DEMA 2DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4T3 Slope 2TEMA Price 3TRIMA Slope 2AROONOSC 2PLUS_DI Threshold 1PLUS_DI Threshold 2ROC Threshold 2WILLR Exit OversoldWILLR Exit OverboughtBOP Smoothed Threshold |

| 28 | 09 Jan | B | EMA Price Cross 4KAMA 2KAMA 4MIDPOINT Slope 2T3 Slope 1T3 Slope 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2AROONOSC 1AROONOSC 3PLUS_DI Threshold 1PLUS_DI Threshold 2ROC Threshold 1ROCR Threshold 3BOP Smoothed ThresholdSTOCH Normal Zone CrossIchimoku 3 |

| 29 | 08 Jan | B | DEMA 1EMA Price Cross 4MIDPOINT Slope 4T3 Slope 1T3 Slope 2TEMA Price 1TEMA Price 2TRIMA Slope 1RSI Exit OversoldBOP Smoothed ThresholdBBANDS Breakout 2Stochastic RSI SignalSchaff Trend Cycle |

| 30 | 07 Jan | S | DEMA 1DEMA 2DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4EMA Crossover 4WMA Crossover 4MIDPOINT Slope 1MIDPOINT Slope 2MIDPOINT Slope 3MIDPOINT Slope 4T3 Slope 1T3 Slope 2TEMA Price 2TEMA Price 3TRIMA Slope 1ROC Threshold 2BOP Smoothed ThresholdDEMA with ATR 2DEMA with ATR 3Donchian ChannelDaily Pivot Point 1CMO Divergence 1 |

Brugerforudsigelser for Sunstone Hotel Investors Inc. (SHO)

Hvad er din forudsigelse?

In this section, you can easily predict without user registration. See also other users predictions.