Gratis Hong Kong dollar med kinesiske yuan (HKDCNY(Forex)) Teknisk Analyse Signaler

Hong Kong dollar med kinesiske yuan (HKDCNY(Forex)) signal med teknisk analyse på 23 Feb

De 256 signaler blev kategoriseret i fire forskellige strategier, hver bestående af 64 signaler. Lad os dykke ned i detaljerne for hver strategi:

Strategi 1:

Købssignaler:

Salgsignaler:

Neutrale signaler:

Resultat: Denne strategi fører til en position.

Strategi 2:

Købssignaler:

Salgsignaler:

Neutrale signaler:

Resultat: Denne strategi fører til en position.

Strategi 3:

Købssignaler:

Salgsignaler:

Neutrale signaler:

Resultat: Denne strategi fører til en position.

Strategi 4:

Købssignaler:

Salgsignaler:

Neutrale signaler:

Resultat: Denne strategi fører til en position.

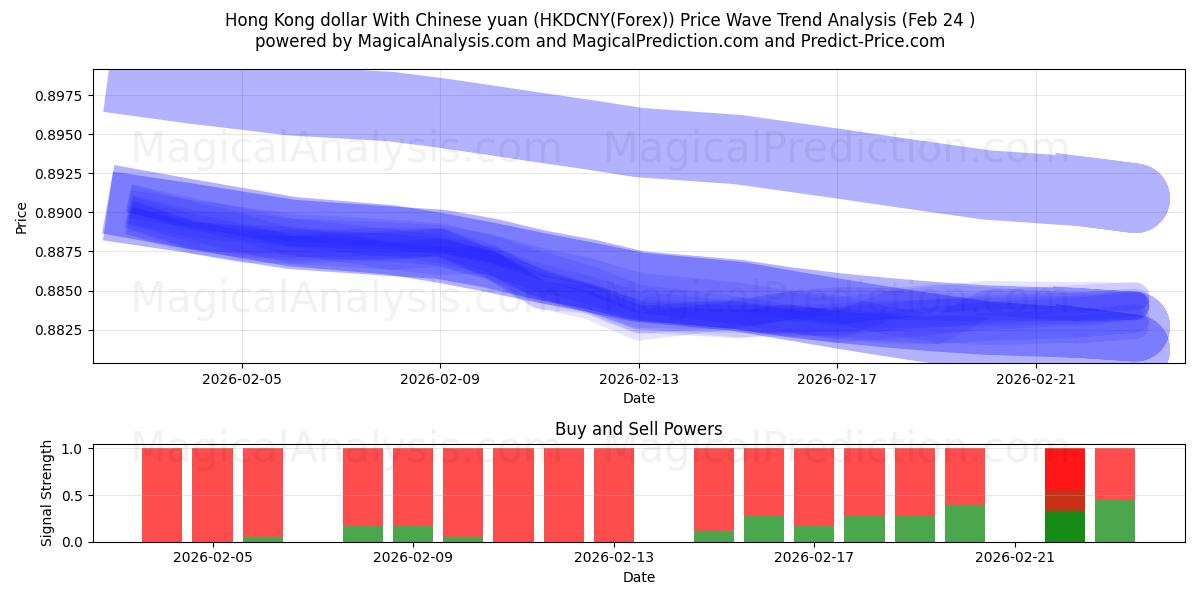

Overordnet strategi:

Købssignaler: 6

Salgsignaler: 20

Neutrale signaler: 73

Resultat: Denne strategi fører til en Sælg position.

Fraskrivelse! Venligst udvis forsigtighed og grundig overvejelse, før du træffer nogen finansielle beslutninger. Det er vigtigt at bemærke, at vores signaler udelukkende er baseret på daglige prisændringer og ikke tager højde for eksterne faktorer såsom nyheder, markedssentiment eller virksomhedens udvikling. Vi anbefaler kraftigt at overveje alle relevante faktorer og udføre din egen forskning.

Nyttige tips: For at træffe de mest informerede beslutninger om dine Hong Kong dollar med kinesiske yuan (HKDCNY(Forex)) investeringer, anbefaler vi stærkt at besøge "magicalprediction" AI-modeller signalwebstedet. De tilbyder gratis signaler, og hvis ét stemmer overens med vores, er det sandsynligvis en pålidelig indikator, som vi har observeret over tid.

Resultat: Når man ser på den tekniske analyse for Hong Kong dollar med kinesiske yuan (HKDCNY(Forex)) den , er der en tendens mod et salgsignal baseret på historiske data og analyse. Det er dog vigtigt at huske, at disse signaler ikke er garantier. Sørg for at overveje de samlede markedsforhold nøje og tilpasse dine beslutninger til dine specifikke investeringsmål.

Baseret på ovenstående signaler og forudsigelser anbefaler vi følgende strategier:

Hong Kong dollar med kinesiske yuan (HKDCNY(Forex)) handelsstrategi for dem i købspositioner (lange positioner): Hvis du i øjeblikket er i en købs (lang) position, er det tilrådeligt at identificere det optimale tidspunkt at afslutte din position baseret på en kombination af tekniske signaler. De med høj risikotolerance kan vælge at vente og observere markedets bevægelser i de kommende dage.

Hong Kong dollar med kinesiske yuan (HKDCNY(Forex)) handelsstrategi for dem i salgspositioner (korte positioner): Hvis du er i en salgs (kort) position, kan det være den rigtige strategi at holde din position, som det er angivet af konsensus i vores tekniske analyse. Vær dog forsigtig og overvåg markedets udvikling nøje.

For nye positioner: Hvis du ikke i øjeblikket er investeret eller overvejer at skifte til en salgs (kort) position, anbefales det at vurdere den potentielle nedadgående risiko på INF% baseret på det laveste forventede prisinterval. Sørg for, at dette stemmer overens med din risikotolerance og mål ved at udføre grundig forskning, før du går ind i en kort position.

I alle handelsituationer er en veldefineret stop-loss strategi afgørende for effektivt at håndtere potentielle nedadgående risici.

Nyttigt tip: For langsigtet forudsigelse anbefaler vi at bruge "Predict-price" webstedet, som tilbyder både kortsigtede og langsigtede forudsigelser uden omkostninger. Denne ressource kan understøtte informerede beslutninger vedrørende dine **Hong Kong dollar med kinesiske yuan (HKDCNY(Forex))** investeringer.

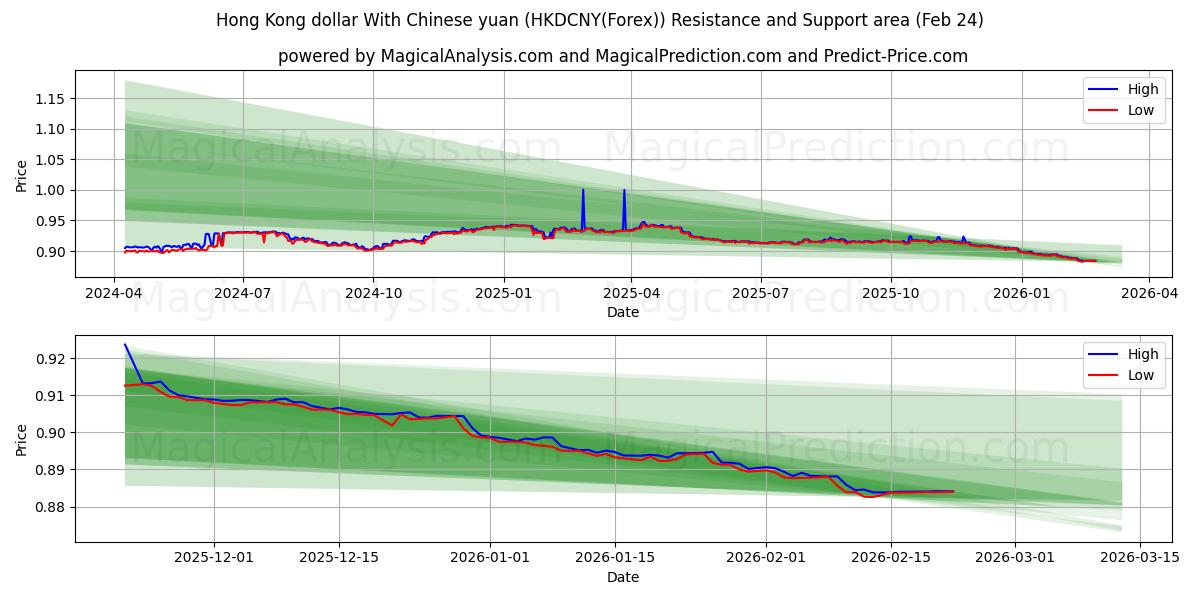

Hong Kong dollar med kinesiske yuan (HKDCNY(Forex)) Prisanalyse og støtte niveauer:

I vores nuværende Hong Kong dollar med kinesiske yuan (HKDCNY(Forex)) position befinder vi os i en kort position og forventer en potentiel nedadgående tendens. Det er vigtigt at forstå de nøgle støtte niveauer, da disse tjener som kritiske referencepunkter for handlende og investorer til at træffe informerede beslutninger.Første støtte niveau: 0

Vi overvåger nøje prisen på 0, det første støtte niveau. Hvis den nedadgående tendens fortsætter, ville brud på dette niveau signalere stærkt salgspres, hvilket tyder på muligheden for yderligere prisfald.

Disse støtte niveauer bør overvejes omhyggeligt inden for rammerne af bredere markedstendenser og indikatorer. Ved at forblive vågen og konstant analysere markedet kan du træffe velinformerede beslutninger, mens du handler Hong Kong dollar med kinesiske yuan (HKDCNY(Forex)). At holde disse støtte niveauer i mente vil hjælpe dig med at tilpasse dig markedets dynamik og træffe smartere handelsvalg.

Hong Kong dollar med kinesiske yuan (HKDCNY(Forex)) teknisk analyse diagram

Hong Kong dollar med kinesiske yuan (HKDCNY(Forex)) støtte- og modstandsniveauer

| Navn | Level1 | Level2 | Level3 | Level4 | Level5 |

|---|---|---|---|---|---|

| Modstand | 1 | -- | -- | -- | -- |

| Understøttelse | -- | -- | -- | -- | -- |

Hong Kong dollar med kinesiske yuan (HKDCNY(Forex)) signalliste for 23 Feb

| Overall Signals |

|---|

Hong Kong dollar med kinesiske yuan (HKDCNY(Forex)) lysestage mønstre på 23 Feb

Hong Kong dollar med kinesiske yuan (HKDCNY(Forex)) teknisk analyse i de seneste dage

| # | Date | Overal Signals | ALL Signals |

|---|---|---|---|

| 1 | 23 Feb | S | DEMA 2DEMA 3EMA Price Cross 4EMA Crossover 1TEMA Price 2TEMA Price 3TRIMA Slope 3AROONOSC 1AROONOSC 3MOM Crossover 1PLUS_DI Threshold 1PLUS_DI Threshold 2RSI Exit OversoldBOP Smoothed ThresholdCMO Divergence 1CMO Divergence 2 |

| 2 | 22 Feb | B | DEMA 3MIDPOINT Slope 3MIDPOINT Slope 4TEMA Price 2TEMA Price 3TRIMA Slope 3PLUS_DI Threshold 1PLUS_DI Threshold 2TRIX Crossover 2BOP Smoothed Threshold |

| 3 | 20 Feb | N | DEMA 3WMA Crossover 2MIDPOINT Slope 3TEMA Price 2TEMA Price 3TRIMA Slope 2TRIMA Slope 3SAR CrossoverPLUS_DI Threshold 1PLUS_DI Threshold 2TRIX Crossover 1BOP Smoothed ThresholdHammer / Hanging ManADXR with DI+/DI-CMO Divergence 1 |

| 4 | 19 Feb | N | TEMA Price 2TEMA Price 3TRIMA Slope 2TRIMA Slope 3PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdMACD Crossover 2Chaikin AD CrossoverHammer / Hanging ManADXR with DI+/DI-CMO Divergence 1 |

| 5 | 18 Feb | N | DEMA 2KAMA 3KAMA 4MIDPOINT Slope 4TEMA Price 2TEMA Price 3TRIMA Slope 2TRIMA Slope 3CCI Crossover 2PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdUltimate OscillatorOBV CrossoverHammer / Hanging ManADXR with DI+/DI-CMO Divergence 1 |

| 6 | 17 Feb | N | KAMA 3KAMA 4WMA Crossover 1TEMA Price 2TEMA Price 3TRIMA Slope 2TRIMA Slope 3PLUS_DI Threshold 1PLUS_DI Threshold 2Money Flow IndexADXR with DI+/DI-Daily Pivot Point 1CMO Divergence 1 |

| 7 | 16 Feb | N | DEMA 1KAMA 1KAMA 2KAMA 3KAMA 4TEMA Price 2TRIMA Slope 2TRIMA Slope 3CCI Crossover 1CCI Crossover 3PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdMACD Crossover 1Hammer / Hanging ManADXR with DI+/DI-CMO Divergence 1 |

| 8 | 15 Feb | S | DEMA 1KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 2TEMA Price 2TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdStochastic RSI SignalADXR with DI+/DI-CMO Divergence 1 |

| 9 | 13 Feb | S | DEMA 2DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 1MIDPOINT Slope 4T3 Slope 1TEMA Price 3TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdEngulfing PatternDEMA with ATR 2DEMA with ATR 3ADXR with DI+/DI-Donchian ChannelDaily Pivot Point 1CMO Divergence 1 |

| 10 | 12 Feb | S | DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 1T3 Slope 1TEMA Price 3TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdBBANDS Breakout 2Stochastic RSI SignalDEMA with ATR 3ADXR with DI+/DI- |

| 11 | 11 Feb | S | DEMA 1DEMA 2DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 1MIDPOINT Slope 2MIDPOINT Slope 3MIDPOINT Slope 4TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3PLUS_DI Threshold 1PLUS_DI Threshold 2ROCR Threshold 3ROCR Threshold 4BOP Smoothed ThresholdDEMA with ATR 1DEMA with ATR 2DEMA with ATR 3ADXR with DI+/DI-Donchian ChannelDaily Pivot Point 1CMO Divergence 1 |

| 12 | 10 Feb | S | DEMA 1DEMA 2DEMA 3KAMA 1KAMA 2KAMA 3KAMA 4WMA Crossover 1MIDPOINT Slope 1MIDPOINT Slope 2MIDPOINT Slope 3MIDPOINT Slope 4TEMA Price 1TEMA Price 2TEMA Price 3TRIMA Slope 2TRIMA Slope 3AROONOSC 3PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdMACD Crossover 1MACD Crossover 2STOCH Normal Zone CrossStochastic RSI SignalDEMA with ATR 1DEMA with ATR 2DEMA with ATR 3Donchian ChannelDaily Pivot Point 1CMO Divergence 1 |

| 13 | 09 Feb | S | DEMA 1DEMA 2DEMA 3KAMA 1KAMA 3KAMA 4WMA Crossover 1TEMA Price 2TEMA Price 3TRIMA Slope 2TRIMA Slope 3PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdMACD Crossover 2CMO Divergence 1 |

| 14 | 08 Feb | N | DEMA 1KAMA 1KAMA 2KAMA 3KAMA 4TEMA Price 2TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3CCI Crossover 1PLUS_DI Threshold 1PLUS_DI Threshold 2MACD Crossover 1Stochastic RSI Signal |

| 15 | 06 Feb | S | KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 3TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3CCI Crossover 3PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdPercentage Price OscillatorEngulfing PatternADXR with DI+/DI-CMO Divergence 1 |

| 16 | 05 Feb | S | KAMA 1KAMA 2KAMA 3KAMA 4T3 Slope 2TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3AROONOSC 4PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdBBANDS Breakout 2ADXR with DI+/DI-CMO Divergence 2 |

| 17 | 04 Feb | S | KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 2MIDPOINT Slope 3MIDPOINT Slope 4T3 Slope 2TEMA Price 3TRIMA Slope 2TRIMA Slope 3PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdSTOCH Normal Zone CrossDEMA with ATR 2DEMA with ATR 3ADXR with DI+/DI-Donchian ChannelDaily Pivot Point 1CMO Divergence 1 |

| 18 | 03 Feb | S | KAMA 1KAMA 2KAMA 3KAMA 4T3 Slope 2TRIMA Slope 1TRIMA Slope 2AROONOSC 2CCI Crossover 3PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdADXR with DI+/DI-Donchian ChannelDaily Pivot Point 1CMO Divergence 1 |

| 19 | 02 Feb | S | KAMA 2KAMA 3KAMA 4T3 Slope 1T3 Slope 2TRIMA Slope 1TRIMA Slope 2PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdMACD Crossover 2BBANDS Breakout 2Stochastic RSI SignalADXR with DI+/DI- |

| 20 | 01 Feb | S | KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 2MIDPOINT Slope 4T3 Slope 1T3 Slope 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2AROONOSC 3PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdADXR with DI+/DI-Donchian ChannelCMO Divergence 1 |

| 21 | 30 Jan | S | DEMA 2KAMA 1KAMA 2KAMA 3KAMA 4MIDPOINT Slope 1MIDPOINT Slope 2MIDPOINT Slope 3MIDPOINT Slope 4T3 Slope 1TEMA Price 2TEMA Price 3TRIMA Slope 1AROONOSC 1CMO Crossover 1CMO Crossover 2PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdDEMA with ATR 2ADXR with DI+/DI-Donchian ChannelDaily Pivot Point 1CMO Divergence 1 |

| 22 | 29 Jan | S | KAMA 2KAMA 3KAMA 4MIDPOINT Slope 1T3 Slope 1TEMA Price 2TRIMA Slope 1PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdADXR with DI+/DI-CMO Divergence 1 |

| 23 | 28 Jan | S | DEMA 1KAMA 1KAMA 2KAMA 3KAMA 4T3 Slope 1TEMA Price 2TEMA Price 3TRIMA Slope 1PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdMACD Crossover 1OBV CrossoverChaikin AD CrossoverChaikin ADOSC Zero CrossADXR with DI+/DI-Donchian ChannelCMO Divergence 1 |

| 24 | 27 Jan | S | DEMA 1DEMA 2EMA Price Cross 1EMA Price Cross 2EMA Price Cross 4KAMA 1KAMA 2KAMA 3KAMA 4EMA Crossover 1WMA Crossover 1WMA Crossover 2MIDPOINT Slope 1MIDPOINT Slope 2TEMA Price 1TEMA Price 2TEMA Price 3SAR CrossoverMOM Crossover 1PLUS_DI Threshold 1PLUS_DI Threshold 2WILLR Exit OversoldWILLR Exit OverboughtBOP Smoothed ThresholdSTOCH Normal Zone CrossStochastic RSI SignalDEMA with ATR 1DEMA with ATR 2ADXR with DI+/DI-Keltner Channel 1Donchian ChannelDaily Pivot Point 1CMO Divergence 1 |

| 25 | 26 Jan | S | DEMA 2DEMA 3EMA Price Cross 2MIDPOINT Slope 1T3 Slope 1TEMA Price 2TEMA Price 3TRIMA Slope 1AROONOSC 1AROONOSC 3MOM Crossover 1PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdDaily Pivot Point 1CMO Divergence 1 |

| 26 | 25 Jan | B | DEMA 1DEMA 2DEMA 3WMA Crossover 2MIDPOINT Slope 1TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 3PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdChaikin ADOSC Zero CrossHammer / Hanging ManCMO Divergence 1 |

| 27 | 23 Jan | B | DEMA 1DEMA 2DEMA 3EMA Price Cross 1EMA Price Cross 4KAMA 1EMA Crossover 1WMA Crossover 1TEMA Price 1TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3SAR CrossoverPLUS_DI Threshold 1PLUS_DI Threshold 2RSI Exit OverboughtBOP Smoothed ThresholdOBV CrossoverChaikin AD CrossoverDaily Pivot Point 1CMO Divergence 1 |

| 28 | 22 Jan | B | DEMA 1DEMA 2DEMA 3KAMA 2KAMA 3KAMA 4MIDPOINT Slope 4TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3CCI Crossover 1CCI Crossover 2PLUS_DI Threshold 1PLUS_DI Threshold 2RSI Exit OversoldTRIX Crossover 2BOP Smoothed ThresholdStochastic RSI SignalADXR with DI+/DI-CMO Divergence 1 |

| 29 | 21 Jan | N | DEMA 1KAMA 1KAMA 2KAMA 3KAMA 4WMA Crossover 1MIDPOINT Slope 1MIDPOINT Slope 2MIDPOINT Slope 3MIDPOINT Slope 4TEMA Price 1TEMA Price 2TEMA Price 3TRIMA Slope 1TRIMA Slope 2TRIMA Slope 3PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdStochastic RSI SignalEngulfing PatternADXR with DI+/DI-Donchian ChannelDaily Pivot Point 1CMO Divergence 1 |

| 30 | 20 Jan | S | DEMA 1DEMA 2DEMA 3KAMA 2KAMA 3KAMA 4WMA Crossover 1MIDPOINT Slope 3TEMA Price 2TEMA Price 3TRIMA Slope 2TRIMA Slope 3CCI Crossover 1CCI Crossover 2PLUS_DI Threshold 1PLUS_DI Threshold 2BOP Smoothed ThresholdMACD Crossover 2Percentage Price OscillatorADXR with DI+/DI-CMO Divergence 1 |

Brugerforudsigelser for Hong Kong dollar med kinesiske yuan (HKDCNY(Forex))

Hvad er din forudsigelse?

In this section, you can easily predict without user registration. See also other users predictions.